At A Glance

Audigent, Dun & Bradstreet, and Experian simplify B2B marketing by combining trusted business data, curated audience activation, and advanced identity resolution. This partnership helps marketers reach verified decision-makers across channels like CTV and display, ensuring accurate targeting, consistent audience identity, and measurable results while maintaining privacy compliance.Audigent, a part of Experian, Dun & Bradstreet, and Experian are collaborating to help business-to-business (B2B) marketers target more effectively. Now, B2B marketers can reach verified decision-makers, keep the same audience across channels, and activate on connected TV (CTV) and digital via the Experian data marketplace. Together, Dun & Bradstreet’s trusted business data, Audigent’s curation and Deal ID activation, and Experian’s identity resolution drive efficient, measurable results.

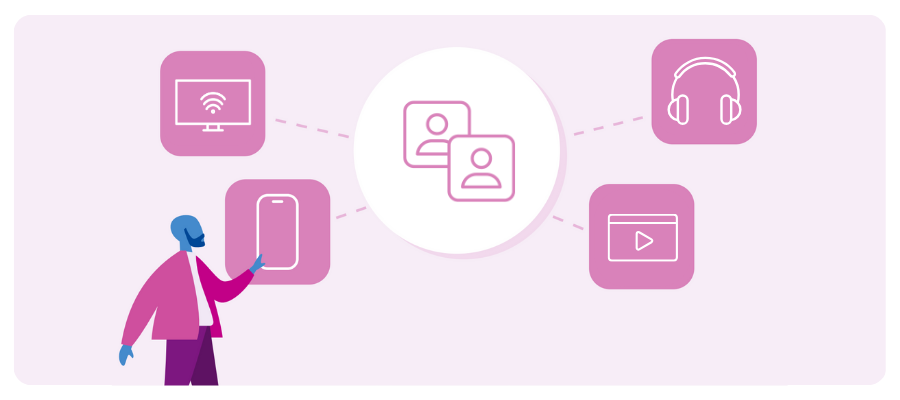

Unify identity and engage B2B audiences

With Audigent, Dun & Bradstreet, and Experian working together, you get one dependable way to recognize the same companies and roles everywhere you run. Dun & Bradstreet’s D-U-N-S® Number, serves as a stable company identifier, so offline business details map to the right digital profiles, and you can reach verified decision-makers with confidence.

Through Audigent and Experian, you can access 400+ Dun & Bradstreet B2B audience segments, matched to a Deal ID and activated via Audigent’s curation engine and Experian’s data marketplace. This provides real-time B2B targeting across connected television (CTV), display, native, audio, and online video (OLV).

Utilize differentiated data

Dun & Bradstreet audiences are built on verified offline signals (e.g., company, industry, size, role, seniority) linked to the proprietary D-U-N-S® Number for deterministic matching. High-quality firmographic attributes become actionable segments you can activate in leading programmatic platforms. The result: privacy-compliant, performance-driven campaigns with omnichannel B2B targeting.

Three ways unified B2B identity improves media performance

- Target with accuracy: Use deterministic firmographics. Dun & Bradstreet’s D-U-N-S® Number anchors a consistent way to recognize the same company, linking offline signals to authenticated business entities.

- Reduce waste: Activate curated PMPs for efficient spend. Audigent’s curation engine packages those audiences into Deal IDs and routes through cleaner, more predictable supply paths, so more budget reaches the buyers that matter. Publishers see up to 75% net revenue increase after fees, while brands save 36–81% on data segments and achieve 10–30% higher video completion rates.

- Stay consistent: Maintain identity across all channels. Use the same audience criteria across CTV, display, native, audio, social, and OLV to improve match consistency without relying solely on third-party cookies.

Improve addressability with Experian’s Digital Graph

Advertisers can use Dun & Bradstreet’s off-the-shelf segments to target specific audiences accurately across channels. By connecting Experian’s Digital Graph with Dun & Bradstreet’s company and contact data, marketers gain a clear advantage: one durable identity that improves match rates, keeps reach consistent across CTV and digital, and aligns targeting with measurement.

What that means in practice:

- Higher match rates without third-party cookies.

- Expect consistent reach across CTV and digital with one audience anchored to the same identity.

- Cleaner measurement because activation and identity stay in sync.

Suggested use cases

Below are simple ways to put this to work, using Dun & Bradstreet business data and Audigent Deal IDs so the same audience runs and measures the same everywhere.

Achieve more with Audigent, Dun & Bradstreet, and Experian

Together, Audigent, Dun & Bradstreet, and Experian allow marketers to activate high-quality B2B audiences with confidence, delivering relevant and efficient campaigns. By pairing Dun & Bradstreet’s trusted business data and proprietary D-U-N-S® Number with Audigent’s curation engine, you get deterministic, privacy-compliant targeting at scale, now boosted by Experian’s identity for consistent cross-channel reach.

Ready to activate your next B2B audience? Talk to an Experian expert today

FAQs

Dun & Bradstreet’s data is anchored by the D-U-N-S® Number, a persistent business identifier that links offline signals like company size, industry, and role to digital environments. This ensures accurate, scalable, and privacy-compliant targeting.

Experian’s Digital Graph connects devices and IDs at the household level, enabling consistent audience identity across channels, even in cookieless environments. This ensures higher match rates and reliable measurement.

Audigent’s curation engine creates audience-aligned Deal IDs and PMPs, optimizing supply paths for efficient media buying. This reduces waste and improves campaign performance with cleaner, more predictable targeting.

Marketers can build role-based segments (e.g., IT Directors at mid-sized companies) and activate them across CTV and digital channels. Sequential messaging tailored to buying stages helps accelerate pipeline and drive engagement.

Latest posts

Cross-Screen Pioneer Explores the Power of Connected Cars as a Vehicle for Customer Engagement LAS VEGAS, NV — (October 26, 2016) –Kate O’Loughlin, GM of Media for Tapad, addressed the J.D. Power Automotive conference audience today in Las Vegas, NV. With more than 1,400 participants representing every facet of the automotive marketing profession, the conference has become the industry's leading marketing event. Bringing the unified, cross-screen perspective to the stage, O’Loughlin discussed the vital role of connected cars in the consumer engagement process. She is a founding member of Tapad which launched the world’s first cross-screen marketing technology in 2010. Tapad was acquired by the Telenor Group early in 2016. Key points from O’Loughlin’s J.D. Power 2016 address included: The marketers who deliver relevant and engaging content in a privacy-safe setting will be in the strongest position to navigate the proliferation of connected devices, including the connected points in cars. As automakers innovate the technology in cars, marketers need to be prepared for the size and diversity of data available for understanding consumers. It’s going to be increasingly difficult to wade through the data, so now is the time to build a solid framework for understanding the person behind the data. Marketers who evolve — and take a holistic approach — to their campaign measurements will achieve marked improvements in efficiency and an enhanced understanding of their core audiences. Actionable brand engagement metrics like Viewable Exposure Time (VET) will continue to overtake traditional advertising performance metrics. VET evaluates the optimal amount of time an ad is present on a screen to incite consumer action. In early testing by Tapad, campaigns that employ VET see conversion rate performance improvements from 13 to 60%. The consumer-centric technology solutions of the future need to be as scalable as they are affordable. Learn more about Tapads’ recommended Viewable Exposure Time metric contact us today! Contact us today

NEW YORK, Sept. 28, 2016 /PRNewswire/ – Tapad, the leader in cross-device marketing technology, today announced a new metric for cross-device marketers, Viewable Exposure Time (VET). Viewable Exposure Time measures across screens and ad formats, identifying the optimal amount of time a consumer spends with an ad before they take action. The announcement coincides with Unify Tech '16, Tapad's third-annual cross-device summit during Advertising Week NY. Frequency caps are currently used to ensure that dollars aren't wasted on redundant ads. Viewable Exposure Time evolves the frequency capping approach to include accelerating a consumer's ad exposure rate up to the optimal time spent with the brand. VET is used in affinity, digital transaction and offline purchase models as a key indicator of marketing budget well-spent. Beta users of VET span every vertical, though interest is especially high from CPG, Automotive, Telecommunications and Retail. Viewable Exposure Time unifies and upgrades marketers' predictors of advertising success by leveraging cross-screen engagement across digital and television, with vendor-agnostic viewability scores for video, rich media and display. "Today's current measurement options, like click-through rate (CTR) and TV gross ratings points (GRP) tell an incomplete story," said Tapad GM of Media Kate O'Loughlin. "Tapad is focused on measuring what really matters to marketers – building an efficient connection with a customer. Innovation in metrics was long overdue." More than just a measurement tool, Tapad also provides clients with VET activation. Factoring in time spent with ads in viewable seconds and minutes, these analytics inform marketers about which audiences are underexposed, enabling them to adjust campaigns and deliver according to optimal viewable exposure time. This effectively increases conversion rates at the lowest cost. Contact us today

Strong Revenue Performance and Thriving Culture Contribute to Industry Recognition NEW YORK, Sept. 15, 2016 /PRNewswire/ — Tapad, the leader in cross-device marketing technology and now a part of Experian, was named a top company on Inc. Magazine’s list of the 5000 fastest-growing private companies in the U.S. In addition, Tapad won the TMCnet 2016 Tech Culture Award. The exclusive Inc. 5000 ranking highlights the fastest-growing privately-held* companies in America. These distinguished companies have achieved success in strategy, service and innovation. TMCnet recognizes talented tech professionals who are committed to building a culture that prioritizes employee growth, collaboration and engagement. Tapad continues to broaden their presence into new markets, having launched in APAC earlier this year, as well as continuing their European expansion. Tapad’s proprietary technology, The Device Graph™ is leveraged by more marketers and brands to understand digital engagement across devices. The company’s rapidly expanding client base includes numerous Fortune 500 company brands as well as all four major advertising holding companies in the U.S. “We have an exceptional team of innovative people who are all working very hard to achieve the kind of results these publications are recognizing,” said Tapad CEO and Founder, Are Traasdahl. “Given that, we have an even greater responsibility to our talent to create an environment that fosters innovation and nurtures open communication. Ultimately, this is how we will continue to reach our very ambitious goals of becoming the world’s leading unified marketing technology provider.” Tapad’s award-winning work culture is defined by its gold-standard benefits which include a six-month parental leave policy, unlimited vacation time, company-sponsored meals and office space designed to facilitate collaboration and open communication. Tapad’s highly talented team has also received multiple customer service awards in 2016. These awards include the iMedia ASPY awards for Best Customer Service and Best Mobile Partner as well as recognition from The Communicator Awards of Excellence in Interactive Media. *Prior to Tapad’s acquisition by Telenor in February 2016. Contact us today