At A Glance

Holiday shopping in 2025 doesn’t follow one clear pattern, with shoppers blending early planning and last-minute purchases, digital discovery and in-store validation, and cautious spending. Marketers who embrace this complexity, by staying relevant, consistent, and connected across channels, will be best positioned to win this season.Holiday shopping in 2025 feels a lot like a complicated relationship. Shoppers want deals, but they also want trust. They start shopping early, but they’re still browsing well into December. They love the convenience of online shopping, but they still show up in-store before making the final call.

Our 2025 Holiday spending trends and insights report, created this year in collaboration with GroundTruth, explores these contradictions. Our findings show that this year’s holiday season isn’t about one big shift; it’s about managing the push and pull between what consumers say, what they do, and how marketers respond.

Here are three complicated truths you need to know.

Experian’s 2025 Holiday spending trends and insights report

Optimize your 2025 holiday shopping campaigns with our latest report with GroundTruth.

Download now1. The new rules of holiday timing

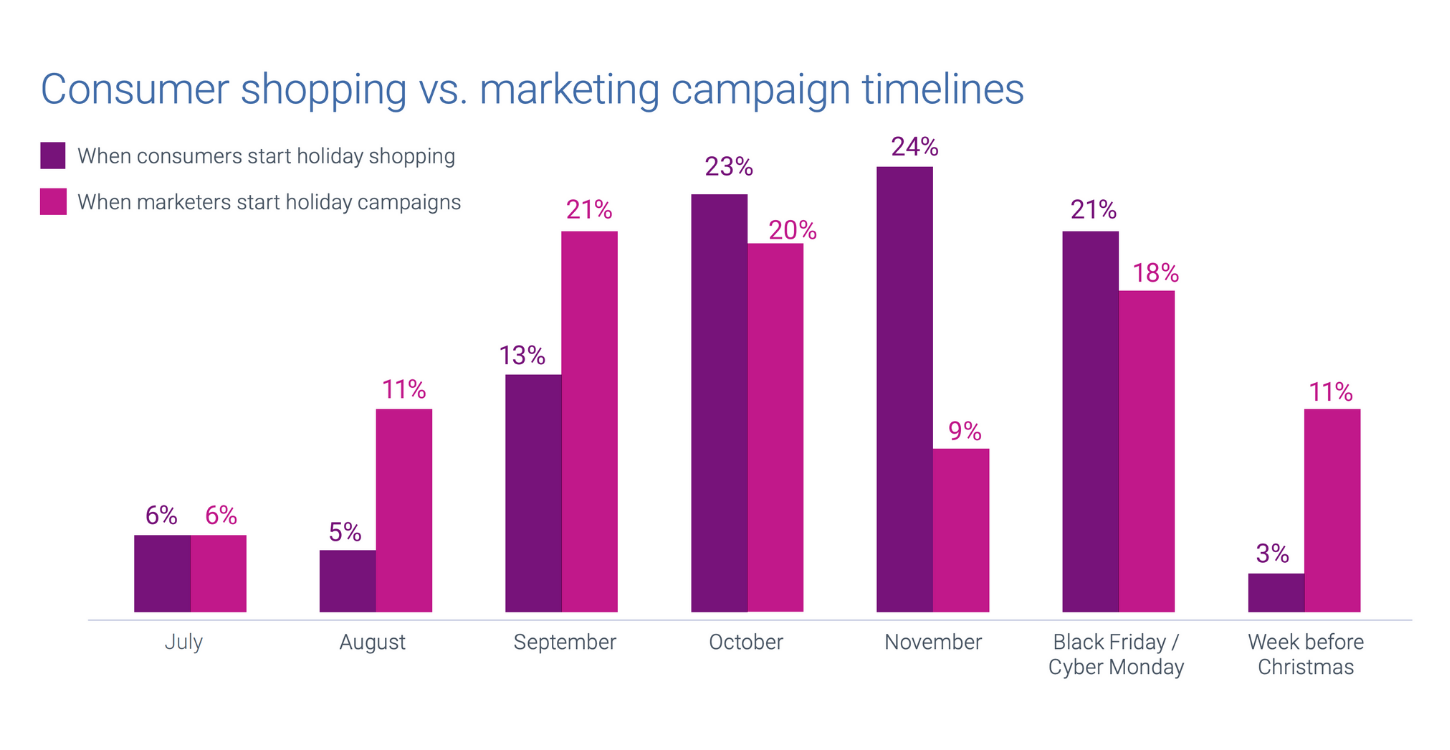

Almost half (45%) of consumers plan to start shopping before November, but 62% admit they’ll still be buying in December. And post-holiday shopping (think gift card redemptions and deal-hunting) remains a real factor.

Why it’s complicated

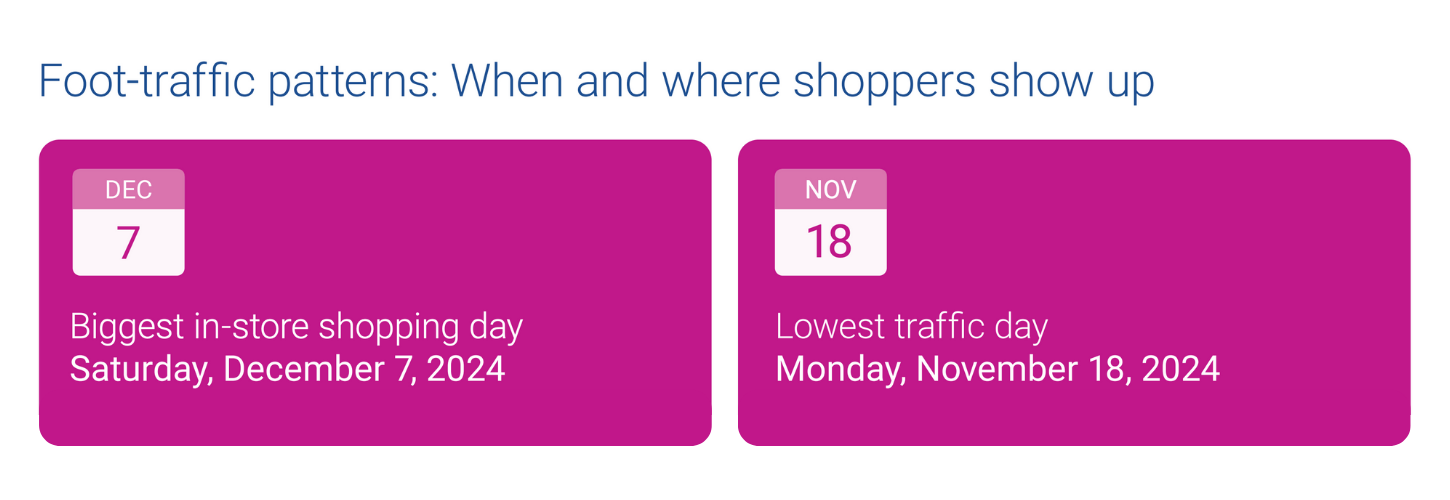

The holiday calendar isn’t what it used to be. There’s no single “big moment” anymore. Instead, shoppers are spreading purchases across months, peaking around the “Turkey 12” (the 12 days surrounding Thanksgiving) and again in the final December rush.

What to do about it

- Stretch your campaigns across the full season, not just Cyber Week.

- Refresh offers to stay relevant as shopper motivations change from deal-seeking to last-minute urgency.

- Watch for post-holiday momentum and extend your promotions into January.

How belVita nailed the timing

In celebration of National Coffee Day, belVita partnered with GroundTruth on a one-month campaign to boost product awareness and drive foot traffic to Target stores. By utilizing digital out-of-home (DOOH) and mobile ads powered by location, behavioral, and purchase-based targeting, the campaign achieved a 3.44% visitation rate, nearly $476k in products added to carts, and a low cost-per-visit of just $0.22.

2. Online leads, but in-store still seals the deal

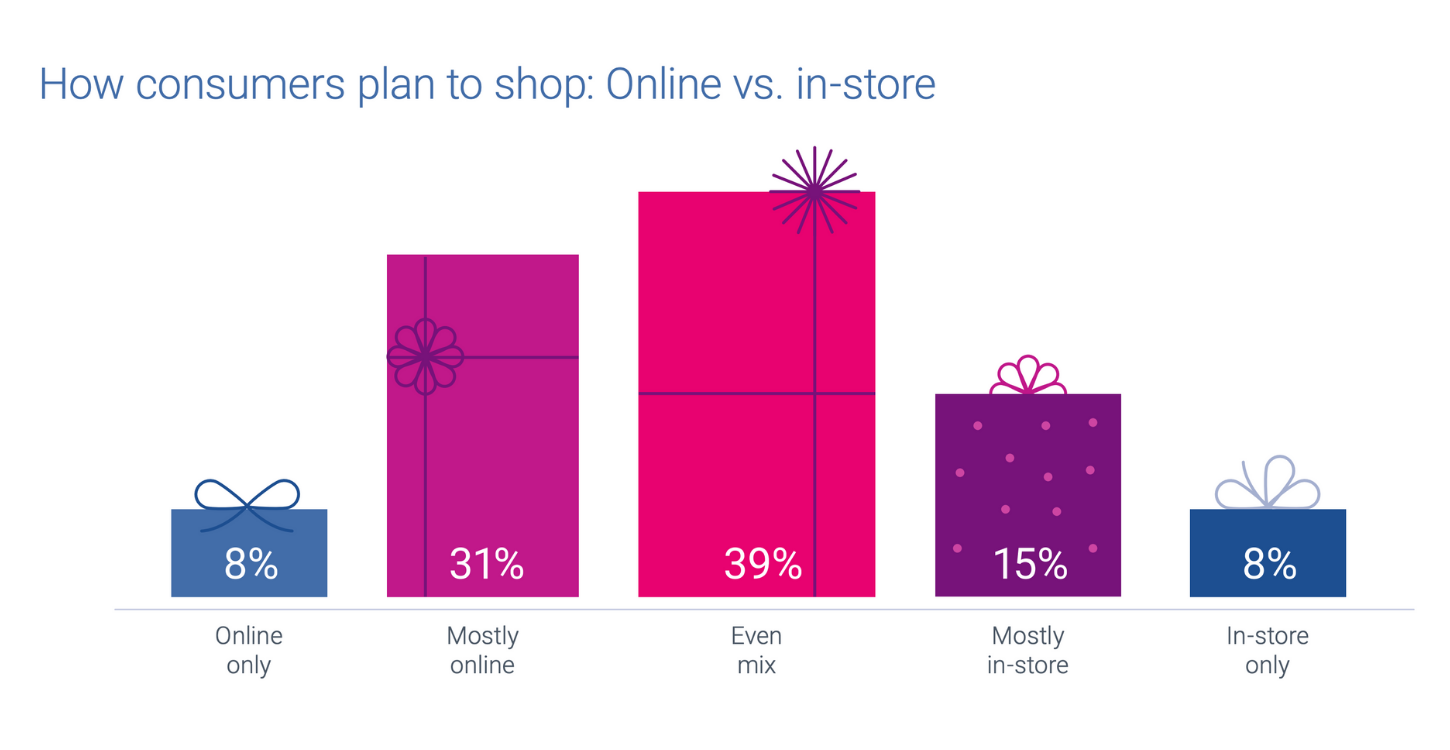

Nearly 40% of shoppers say they’ll split their purchases between online and in-store and 80% of consumers still prefer the in-store experience. Only a small fraction plan to shop exclusively in one channel. That means while digital often starts the journey, the final decision often happens in a physical store.

Why it’s complicated

Shoppers love the convenience of browsing online, but they still want the reassurance of seeing, touching, or testing products before buying. In-store isn’t just about the transaction, it’s the validation step.

What to do about it

- Build omnichannel strategies that connect digital discovery with in-store follow-through.

- Use location and identity data to tie digital impressions to real-world actions, like foot traffic and purchases.

- Focus on consistency: shoppers expect the same value, tone, and trust whether they’re on a website, in an app, or standing in a store aisle.

How Duke Cannon used on-premise targeting to drive sales lift

Duke Cannon, a premium men’s grooming brand, partnered with GroundTruth to launch a successful multichannel campaign utilizing location-based and behavioral audience targeting across CTV and mobile screens to drive in-store visits and sales.

By targeting consumers with mobile ads while they were physically in-store, the company capitalized on high purchase intent, aiding in the 12% sales lift. This strategic approach resulted in over 43.9k provable in-store visits and a significant increase in sales.

3. Marketers double down, consumers hold back

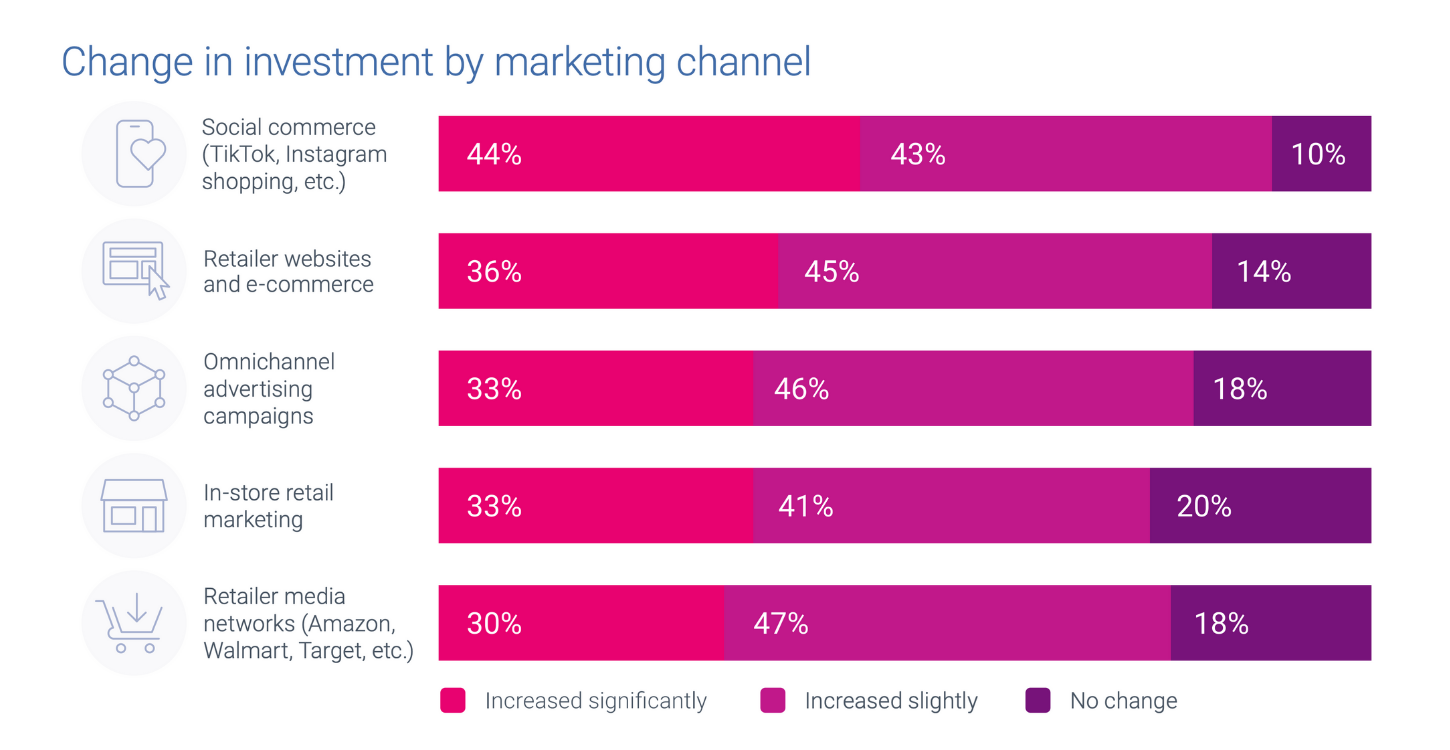

This holiday season, expectations are split. 66% of marketers expect holiday spend to rise, but only 22% of consumers agree. While brands are leaning into bigger investments across CTV, retail media, and social, shoppers are staying cautious, weighing value and waiting for the right deal.

Why it’s complicated

That disconnect introduces risk. If marketers don’t align spend with real consumer behavior, budgets can get wasted in the rush to cover every channel. Shoppers haven’t stopped spending, but they’re spending differently. They’re trading down to discount and big-box retailers while cutting back in discretionary categories like apparel and restaurants.

What to do about it

- Prioritize efficiency by focusing on the right audiences, not just more impressions.

- Make consistency your advantage: reach people once and connect across platforms instead of chasing fragmented signals.

- Balance aggressive media investment with messaging that acknowledges consumer caution — shoppers want value and trust, not hype.

Measuring TV and streaming impact with iSpot

iSpot’s Audience Builder, powered by Experian’s Marketing Attributes, helps brands reach high-value audiences. During the holiday season, a luxury retailer could target $100K+ households with affluent lifestyle interests. With iSpot’s Unified Measurement platform, they can track performance across linear TV and streaming and shift spend in real time to maximize results.

The bottom line on 2025 holiday shopping trends

This year’s holiday shopping season is, well…complicated. Shoppers are cautious but still engaged. They’re early planners and last-minute browsers. They want the ease of digital, but the confidence of in-person.

For marketers, the opportunity lies in embracing that complexity, not trying to simplify it away. The brands that balance relevance, trust, and convenience across the full season and across every channel will be the ones that win.

Download our full 2025 Holiday spending trends and insights report to explore all five shifts shaping this season and see how you can turn complexity into opportunity.

About the author

Fred Cheung

Director, Partnership Sales, Audigent, a part of Experian

Fred Cheung has spent over a decade in the programmatic advertising space, with roles at Mindshare, Jounce Media, Twitter, and The Trade Desk. His deep experience in trading and product management helps in his current function on the Experian Marketing Services’ Sales team where he focuses on data growth and adoption across the industries’ leading buy-side platforms.

2025 holiday shopping trends FAQs

Because consumer behavior is full of contradictions. People will shop earlier but also later, browse online but purchase in-store, and want deals while demanding trust. Marketers need to navigate these push-and-pull dynamics.

Nearly half (45%) say they’ll start before November, but 62% admit they’ll still be buying in December, with momentum even continuing into January through gift card redemptions and deal-hunting.

Although many consumers begin online, the majority still make their final decisions in-store. In-person shopping acts as a validation step where customers can see, touch, or try products before buying.

Instead of focusing only on Black Friday or Cyber Week, marketers should stretch campaigns across the full season, refresh offers frequently, and continue promotions into January.

Not entirely. 66% of marketers expect spending to rise, but only 22% of consumers agree. Shoppers are cautious, prioritizing value and often trading down to discount or big-box retailers.

An omnichannel approach using identity and location data can bridge digital impressions with real-world actions like store visits and purchases, ensuring consistency across touchpoints.

Brands like belVita and Duke Cannon successfully tied digital campaigns to in-store results by utilizing precise audience targeting, location data, and well-timed promotions.

You can download Experian’s 2025 Holiday spending trends and insights report to explore all five shifts shaping this season.

Latest posts

Learn how energy and utility marketers use Experian Audiences to reach households based on energy usage, sustainability interest, and tech adoption.

Learn how first-party data activation improves relevance, efficiency, and measurement in 2026.

Kevin Dunn has been Chief Revenue Officer at Experian Marketing Services for one month. Here are his thoughts on his first 30 days.