We surveyed 6,000 consumers and 2,000 businesses from 20 countries worldwide as part of our ongoing efforts to learn more about how, why, and where consumers interact with businesses online.

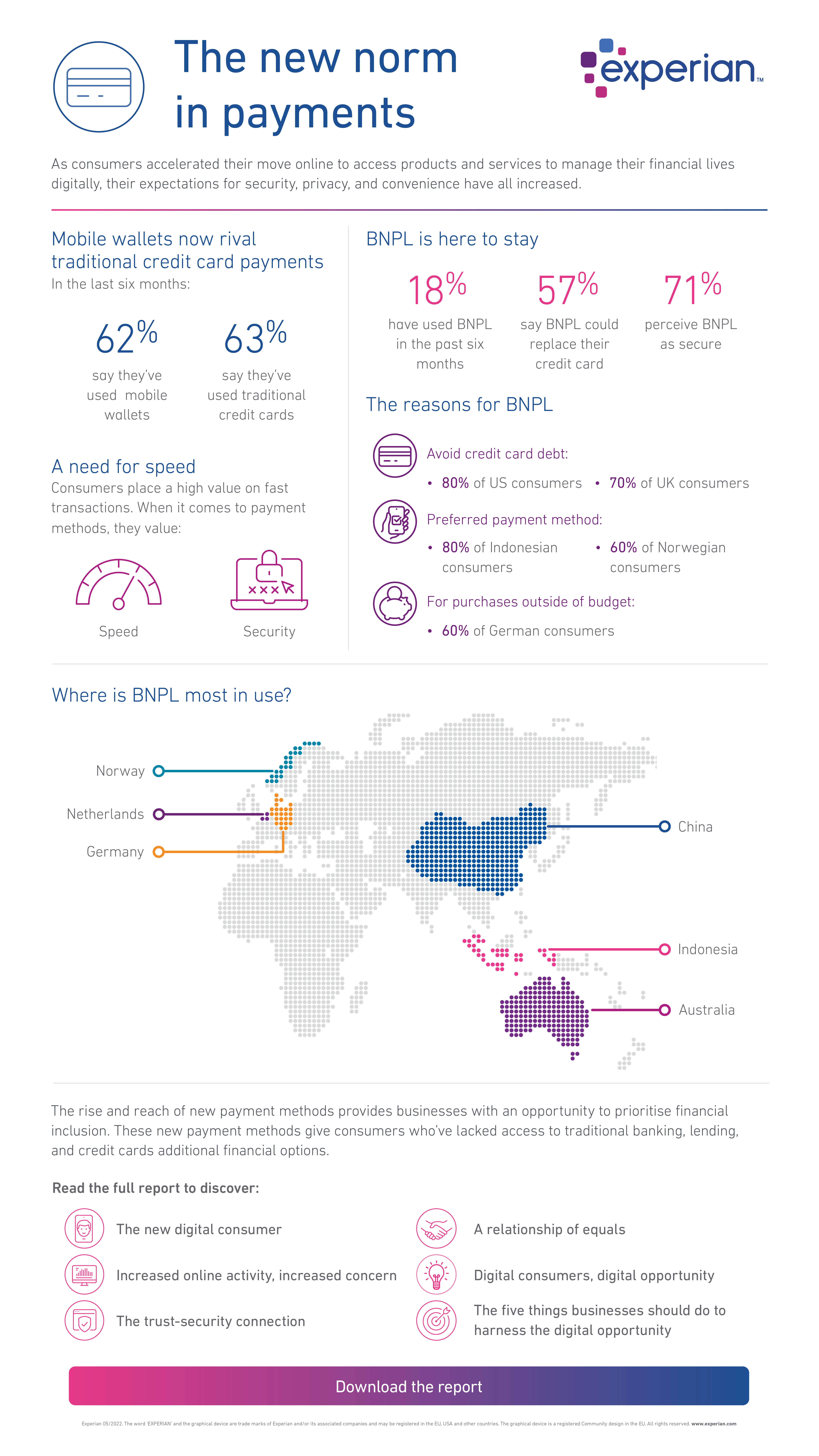

The new norm in payments

As consumers accelerated their move online to access products and services to manage their financial lives digitally, their expectations for security, privacy, and convenience have all increased.

Mobile wallets now rival traditional credit card payments In the last six months:

62% say they’ve used mobile wallets

63% say they’ve used traditional credit cards

A need for speed Consumers place a high value on fast transactions. When it comes to payment methods, they value:

Speed

Security

BNPL is here to stay

18% have used BNPL in the past six months

57% say BNPL could replace their credit card

71% perceive BNPL as secure

The reasons for BNPL

Avoid credit card debt:

80% of US consumers

70% of UK consumers

Preferred payment method:

80% of Indonesian consumers

60% of Norwegian consumers

For purchases outside of budget:

60% of German consumers

Where is BNPL most in use?

Norway

Netherlands

Germany

China

Indonesia

Australia

The rise and reach of new payment methods provides businesses with an opportunity to prioritise financial inclusion. These new payment methods give consumers who’ve lacked access to traditional banking, lending, and credit cards additional financial options.

Read the full report to discover:

The new digital consumer

Increased online activity, increased concern

The trust-security connection

A relationship of equals

Digital consumers, digital opportunity

The five things businesses should do