Small Business Credit Insights

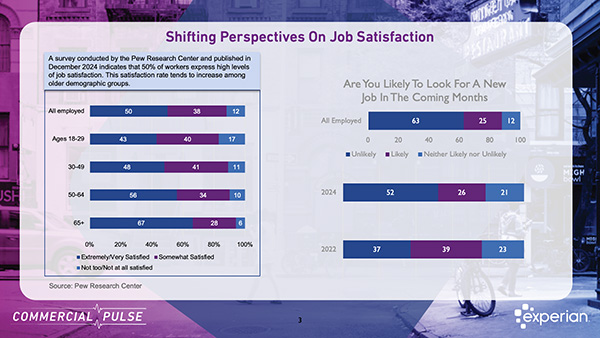

Despite concerns about a slowing job market, job satisfaction among American workers remains high.

The Experian Small Business Index™ rose by 3.9 points in February, reaching 45.4, marking the second consecutive month of modest gains.

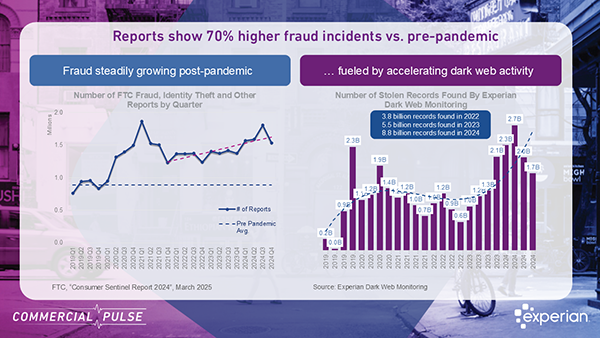

This week we focus on 2025 small business financial fraud, why it has increased, key stats, and strategies to protect your business.

The Experian Small Business Index increased by 1.0 pt in January signaling a modest improvement after December’s decline.

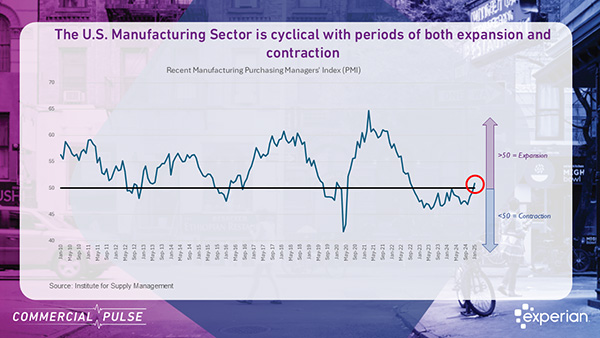

Experian reports the manufacturing sector may be on the verge of a shift after more than two years of contraction | Commercial Pulse Report

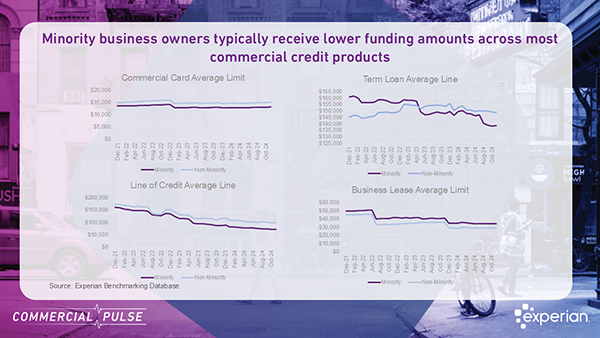

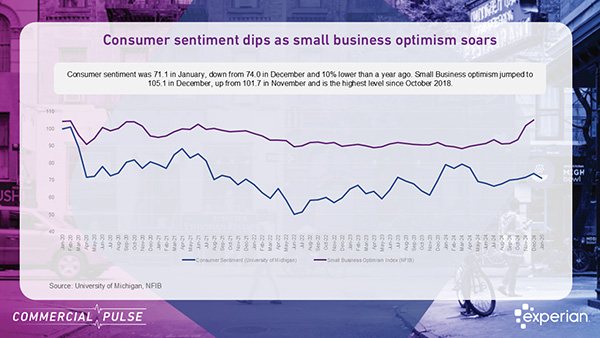

The Commercial Pulse Report | 2/25/2025 The latest Experian Commercial Pulse Report provides a snapshot of the evolving U.S. economic landscape, highlighting key macroeconomic trends and the growing impact of minority-owned businesses. As inflation persists and credit markets tighten, small businesses are navigating a complex financial environment. However, within this challenge lies a significant opportunity—supporting minority-owned businesses, a rapidly expanding sector generating over $2 trillion in annual revenue. Watch Our Commercial Pulse Update Macroeconomic Highlights: Inflation, Employment, and Consumer Trends Inflation and Interest Rates - Inflation remains a key concern for small businesses, rising to 3.0% in January, marking the fourth consecutive monthly increase and the highest level since June 2024. Core inflation, which excludes food and energy, also increased to 3.3%, signaling persistent pricing pressures across industries. Rent inflation showed some relief, dropping to 4.4%, but food inflation remained high at 2.5%, while energy inflation increased for the first time in six months. Employment and Wages - The U.S. labor market is showing mixed signals. The unemployment rate stands at 4.0%, slightly down from December, yet job creation has slowed dramatically. Only 143,000 jobs were added in January, a significant drop from 307,000 in December, marking the weakest growth in three months. At the same time, wages have risen to $30.84 per hour, which may contribute to inflationary pressures for businesses. Consumer Spending and Retail Sales -Retail activity has softened, with January retail sales declining 0.9% month-over-month, the largest drop since March 2023. However, year-over-year sales remain up 4.2%, indicating that while consumers are spending more cautiously, demand is still present. Small Business Sentiment and Credit Markets - The NFIB Small Business Optimism Index declined to 102.8 in January from 105.1 in December, reflecting growing concerns among business owners. The uncertainty index surged 14 points to 100, the third-highest level on record, suggesting businesses are wary about future economic conditions. Credit access remains a major concern, reflected in the Experian Small Business Index, which dropped to 40.5, down from 42.9 last month and 11 points lower year-over-year. This decline underscores the increasing difficulty small businesses face in securing credit to fund growth and operations. The Opportunity: Minority-Owned Businesses Are Thriving but Need More Support One of the most compelling insights from this month’s Commercial Pulse Report is the remarkable growth of minority-owned small businesses. These enterprises are expanding at a much faster rate than non-minority-owned businesses and now represent a significant share of new commercial account originations. Key Growth Trends Over 8 million minority-owned businesses contribute more than $2 trillion in annual receipts, representing a powerful economic force. Between 2014 and 2019, the number of minority-owned businesses increased by 35%, compared to just 4.5% growth among non-minority businesses. Minority-owned businesses make up 41% of new commercial accounts, up from 37% in 2021, underscoring their increasing role in the broader business ecosystem. Funding Gaps and Credit Access Challenges Despite this rapid growth, minority-owned businesses continue to face challenges in accessing credit: On average, they receive 7% - 37% less funding across most commercial lending products. Businesses under six years old account for 44% of new commercial accounts for minority-owned firms, compared to just 31% for non-minority firms, yet they struggle to secure the funding they need to scale. This funding gap is not due to higher credit risk—minority-owned businesses exhibit comparable commercial credit performance to their non-minority counterparts. Industries Driving Minority Business Growth Minority-owned businesses are expanding into high-growth sectors such as: 🏗 Construction🛍 Retail🍽 Accommodation & Food Services💡 Technology & Healthcare These industries require significant upfront capital for expansion, making access to credit crucial for long-term success. What This Means for Lenders and Policymakers The disconnect between strong minority business growth and limited access to funding presents a major opportunity for lenders. For Lenders: Expanding lending opportunities for minority-owned businesses represents a high-growth market with proven credit performance. Bridging this funding gap can unlock billions in economic activity while serving an underserved business community. For Policymakers: Addressing structural barriers to credit access can further accelerate job creation, economic expansion, and financial inclusion in communities nationwide. Final Thoughts: Investing in the Future of Small Business The U.S. small business landscape is evolving. While macroeconomic headwinds—such as rising inflation and uncertain credit markets—present challenges, minority-owned businesses are demonstrating resilience, expansion, and growing demand for capital. For lenders, this is a $2 trillion opportunity to support a fast-growing sector with proven potential and unmet capital needs. By addressing credit access barriers, financial institutions can drive both economic growth and financial inclusion in the years ahead. Download the Commercial Pulse Report Visit Experian Small Business Index Related Posts

Experian’s Q4 FY25 Report reveals small business credit trends, lending shifts, and economic forces shaping growth amid policy changes and global uncertainties.

Experian shared the latest insights on small business credit conditions and presented key findings from the Main Street Report for Q4 2024 during the Quarterly Business Credit Review. Our lead presenter, Brodie Oldham, provided his perspective on the macroeconomic environment and conducted a deep dive into the Q4 Main Street Report, along with the most recent small business credit data. The session concluded with a live Q&A where we addressed audience questions. Key Highlights from the Webinar: Presentations by leading experts on commercial and macro-economic trends Credit insights and trends on over 30 million active businesses Coverage of industry hot topics, including business owner and small business data Exclusive commercial insights unavailable elsewhere Peer insights gathered through interactive polls Discovery of key small business trends to support informed decision-making Actionable takeaways based on the latest credit performance data Get Notified About Future Webinars

Commercial Pulse Report insights, including small business optimism vs consumer confidence, and the Experian Small Business Index.