The appetite for businesses incorporating big data is growing significantly as the data universe continues to expand at an astronomical rate. In fact, according to a recent Accenture study, 79% of enterprise executives agree that companies that do not embrace big data will lose their competitive position and could face extinction.

Especially for financial institutions that capture and consume an incredible amount of data, the challenge becomes how to make sense of it. How can banks, credit unions, and other lenders use data to innovate? To gain a competitive advantage?

This is where analytics sandboxes come in.

A sandbox is an innovation playground and every data-consuming organizations’ dream come true. More specifically, it’s a platform where you can easily access and manipulate data, and build predictive models for all kinds of micro and macro-level scenarios. This sounds great, right? Unfortunately, even with the amount of data that surrounds financial services organizations, a surprising number of them aren’t playing in the sandbox today, but they need to be. Here’s why:

Infinite actionable insights at your fingertips

One of the main reasons lenders need a sandbox environment is because it allows you to analyze and model many decisioning scenarios simultaneously. Analysts can build multiple predictive models that address different aspects of business operations and conduct research and development projects to find answers that drive informed decisions for each case. It’s not uncommon to see a financial services organization use the sandbox to simultaneously:

- Analyze borrowing trends by type of business to develop prospecting strategies

- Perform wallet-share and competitive insight analyses to benchmark their position against the market

- Validate business credit scores to improve risk mitigation strategies

- Evaluate the propensity to repay and recover when designing collection strategies

A sandbox eliminates the need to wait on internal prioritization and funding to dictate which projects to focus on and when. It also enables businesses to stay nimble and run ad-hoc analyses on the fly to support immediate decisions.

Speed to decision

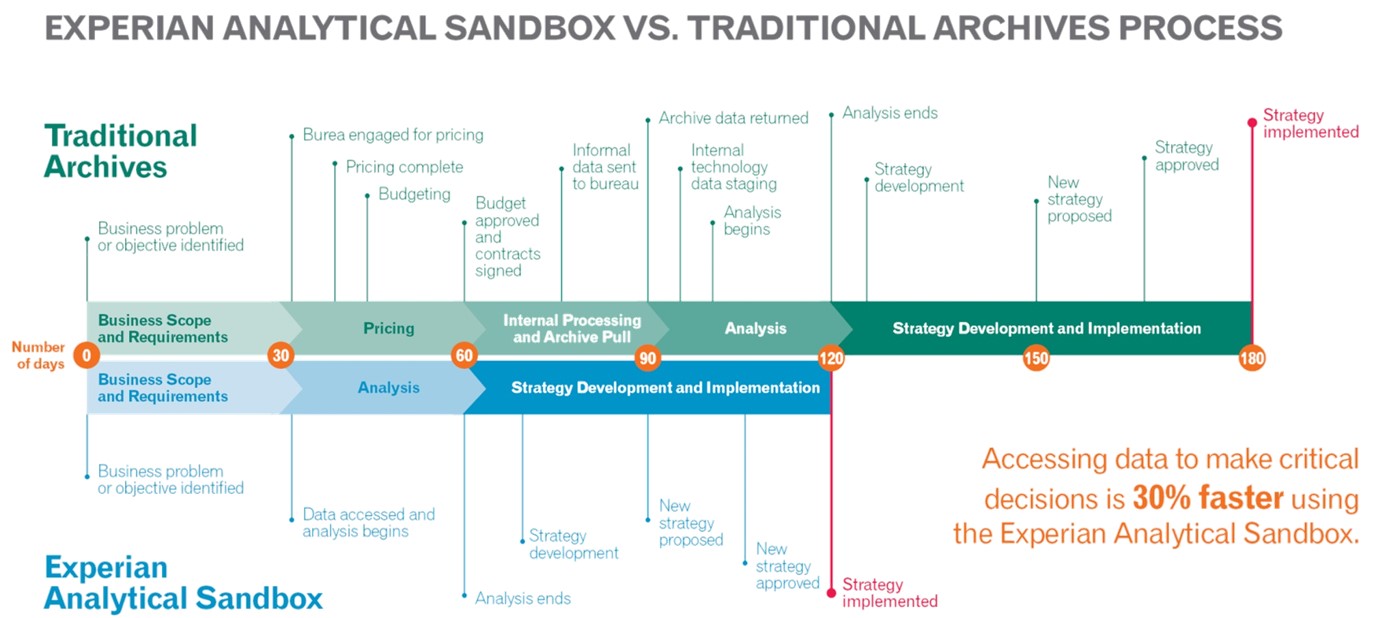

Data and the rapid pace of innovation make it possible for nimble companies to make fast, accurate decisions. For organizations that struggle with slow decision-making and speed to market, an analytics sandbox can be a game-changer. With all your data sources integrated and accessible via a single point, you won’t need to spend hours trying to break down the data silos for every project. In fact, when compared to the traditional archive data pull, a sandbox can help you get from business problem identification to strategy implementation up to 30% faster, as seen with Experian’s Analytical Sandbox:

Cost-effective analytics

Building your own internal data archive with effective business intelligence tools can be expensive, time-consuming, and resource-intensive. This leaves many smaller financial services at a disadvantage, but sandboxes are not just for big companies with big budgets. An alternative solution that many are starting to explore is remotely hosted sandboxes. Without having to invest in internal infrastructure, this means fast, data-driven decisions with little to no disruption to normal business, fast onboarding, and no overhead to maintain.

For financial institutions capturing and consuming large amounts of data, having an analytical sandbox is a necessity. Not only can you build what you want, when you want to address all types of analyses, you’ll have the insights to support business decisions faster and cheaper too. They prove that effective and efficient problem solving IS possible!

Ready to learn more about Experian’s Analytical Sandbox and how it can help you optimize your business?