Within the span of two weeks, two states in the Southeast – Texas and Florida, have been devastated by two category 5 hurricanes. It has been over a decade since the United States last fell victim to another category 5 hurricane, Katrina, which submerged New Orleans under 20 feet of water and displaced 1.3 million people to find shelter anywhere and everywhere across the U.S. However, within one year, New Orleans would see 66% of its pre-Katrina population return, and sales tax revenue climb to 84% of pre-Katrina levels.The road to recovery will no doubt be arduous, but there is also no doubt that the resilient people of these states are already marching steadfastly on that road.

The recovery effort is supported by FEMA, the U.S. Federal Emergency Management Agency, which has already approved $124 million to support individuals and households in Florida and $408 million to support those residents impacted in Texas. Along with direct support for its people, the U.S. government is accepting and approving SBA loans for businesses impacted by Hurricane Irma and Harvey. As residential rebuilding plans begin, many of the people living in these regions are also employees and business owners whose places of work may also need weeks or months to rebuild, if they rebuilt at all. How quickly the area’s economy recovers has obvious implications for the people and businesses in the region, but it also has far-reaching implications for businesses that depend on the region as a source of revenue as well. Experian is looking to its wealth of business credit data to gauge the overall magnitude of the disaster and the impact to regional businesses.

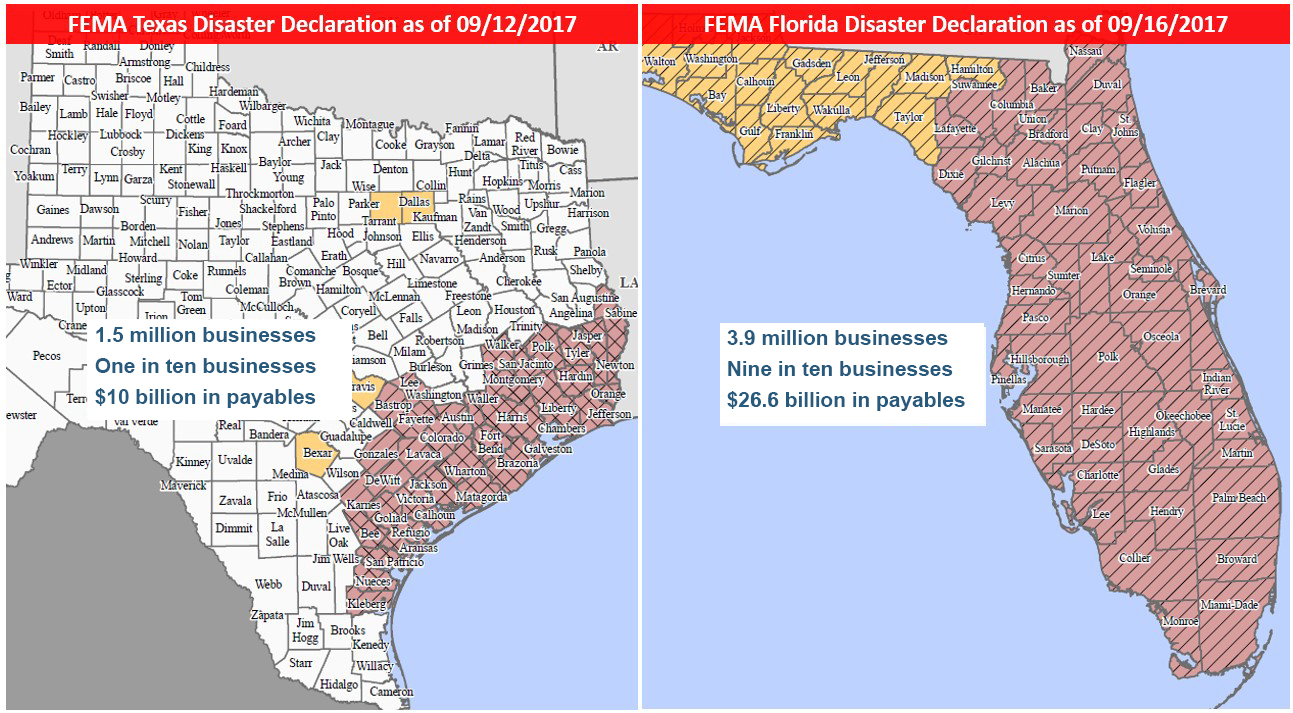

Nearly 1.5 million businesses in Texas are in FEMA declared Hurricane Harvey impacted counties. This represents one in three businesses in all of Texas. The businesses impacted have $10 billion in outstanding payables and represents 31% of all commercial payable balances in Texas. The businesses in the impacted regions, on average, have very similar credit profiles to the rest of the businesses in Texas, with the typical business being 10 years old, paying 7 days late, and having an Intelliscore Plus commercial credit score of 41 out of 100.

In Florida, nearly all of the state has been enveloped by Hurricane Irma. 3.9 million businesses reside in Irma impacted counties, accounting for nine out of ten businesses in Florida. These impacted businesses represent 91% of total outstanding commercial payables in Florida, summing to over $26.6 billion. That is over two and a half times higher the balance potentially at risk in Texas. As of August 2017, $3 billion of the payables are delinquent, and as most businesses focus on recovery, these delinquent dollars may slide into further delinquency. Businesses in Florida are, on average, slightly over 10 years old, pay 8 days late, and have an Intelliscore Plus score of 41.

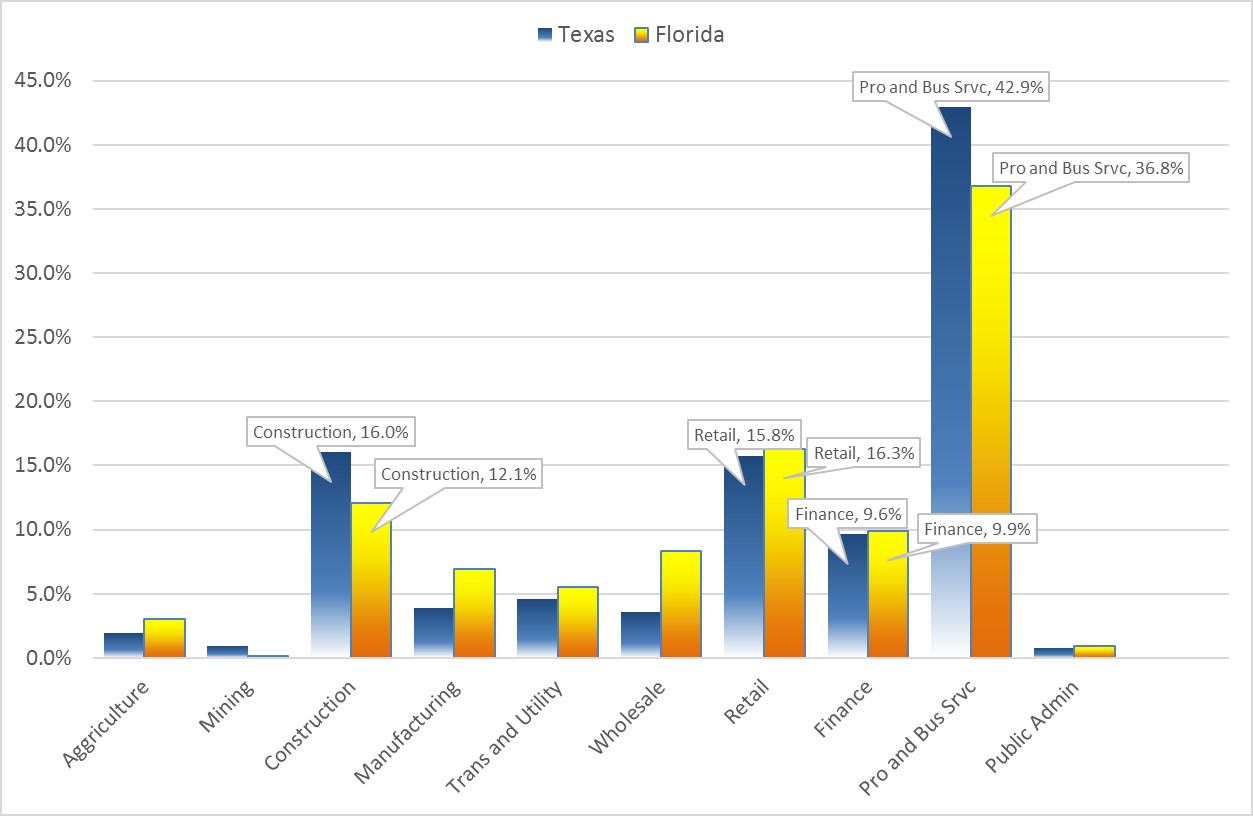

From an industry sector point of view, professional and business services were hardest hit in both states, with these businesses accounting for over 40% of all businesses impacted for each state, respectively. In Texas, professional and business services owe $2 billion in payables. In Florida, businesses in this sector carried over three times that balance, owing $6.5 billion in payables, with over $700 million already delinquent. In Texas, other industry sectors significantly affected include construction and retail trade, each accounting for 16% of businesses in the impacted region, and having $7.6 billion and $9.6 billion in total payables, respectively. In Florida, retail trade businesses represent 18% of all businesses affected, and account for $2.9 billion in commercial trade balance owed. Businesses in finance, insurance, and real estate account for 12% of businesses in the impact zones, and owe $1.7 billion in outstanding balance. Construction businesses in Florida represent nearly 10% of businesses affected. As Florida has a smaller percentage of businesses in the construction industry overall compared to Texas (10.1% vs 14.5% respectively), and 90% of construction businesses in Florida are in designated impact counties, Florida may require more assistance from outside the state to support their rebuilding effort.

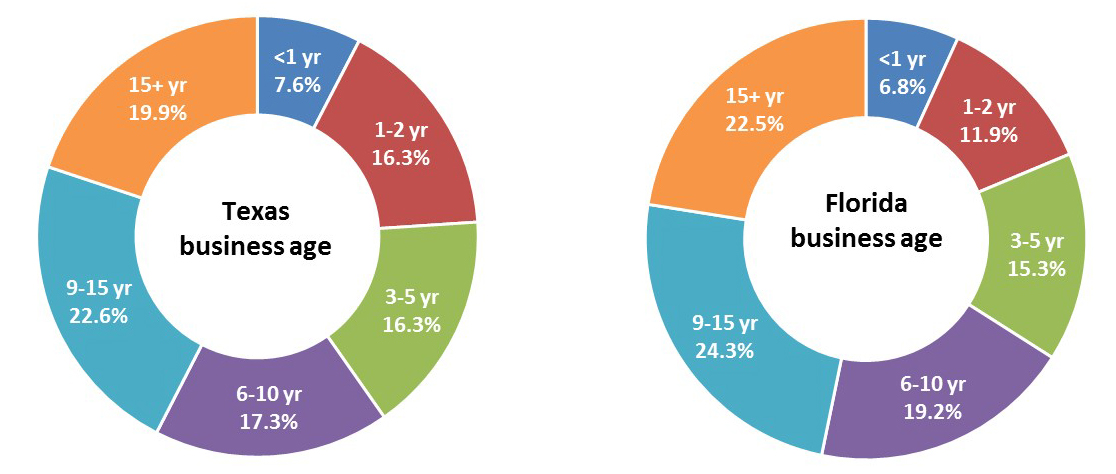

Smaller and younger businesses in general face lower odds of continued prosperity, and these businesses are the most susceptible to the devastation of Hurricane Harvey and Hurricane Irma. The impacted areas for both states are dominated by smaller businesses, with nearly 90% of businesses having four or less employees, and almost 100% having less than 50 employees. Even though they are small, these businesses account for $8.7 billion, or 86% of payables impacted, in Texas. In Florida, these small businesses total $23.8 billion in payable balance, which constitutes 90% of all impacted payables. Many of these small businesses are young, but Florida businesses are more mature than businesses in Texas. In Florida, 3.5 businesses out of 10 have been credit active for less than six years, compared to 4 out of 10 businesses in Texas. These young businesses in Texas owe a total of $2.7 billion, while young businesses in Florida owe two and a half times that amount, at $6.9 billion.

Over the next several months, Experian will measure the financial impact of businesses caught in the devastating path of Hurricanes Harvey and Irma. We will track changes in key metrics that can provide insight into the level of progression of recovery by location and type of business. Businesses integral to the recovery efforts, such as home improvement suppliers, construction companies, sanitary service companies, and the workers they employ, will undoubtedly prosper as their products and services are immediately in demand and in short supply.Younger businesses and businesses in more severely impacted regions will have a difficult road ahead. We will continue to track credit activity, such as changes in spend, utilization, new trade openings, and payment delinquency trends, to identify business sectors and profiles that appear to be rebounding, and those in further need of assistance.

Subscribe to our blog for the latest updates on the business recovery progress from Hurricanes Harvey and Irma.