Free credit report

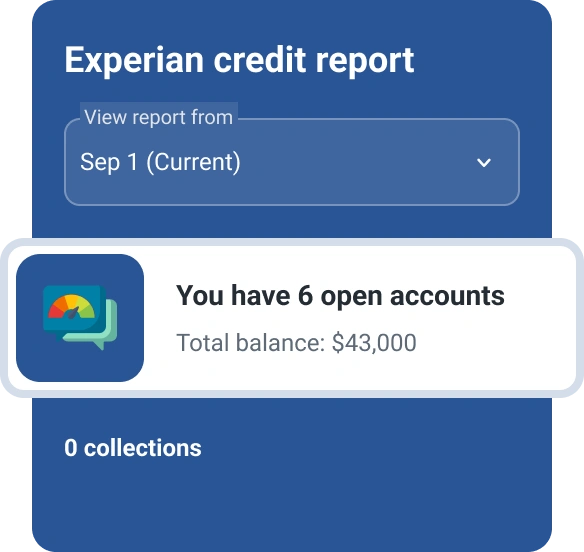

Check your Experian credit report and FICO® Score* to understand how you may look to lenders.

No credit card required

See your latest credit info

Better understand your credit with an overview of where it currently stands.

Get free credit monitoring

Check for changes with a credit report updated daily.

Get to know your FICO® Score

View specific factors that are affecting your score and how to improve it.

Why check your free credit report with Experian?

What can you do with your credit report?

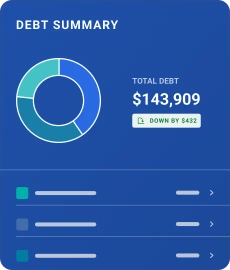

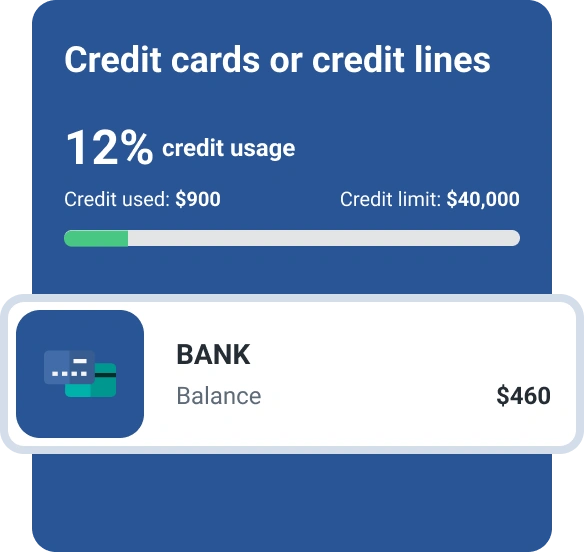

Pay down your debt

Credit reports show all your debt, including revolving credit and installment loans, so you can make a plan to tackle your debt and improve your financial health.

Manage unpaid accounts

Bankruptcies or accounts that get sent to collections can have a significant impact on your credit score. You can check how much you currently owe on outstanding accounts.

Access your payment history

Payment history is an important factor in determining your credit score. Your credit report shows on-time, overdue or late payments across your accounts.

Review credit inquiries

Your credit report shows hard inquiries like when you’re applying for new credit or a loan. Soft inquiries appear when lenders run a credit check or you check your own credit.