Small Business Matters is written and managed by the Experian Small Business team. Subscribe for business credit education, expert advice, and helpful articles to build a strong knowledge of business credit so you can scale and grow your business.

Business Credit Reports & Scores

Your business has a credit score too and it can be pivotal to your success. Learn more about building strong business credit.

Read moreCustomer Testimonials

Hear what Experian small business customers have to say about our credit report subscriptions; and the difference it makes.

View TestimonialsNews & Research

Stay ahead of the curve by being informed about industry trends and policies that impact small businesses.

Read moreThe latest from our experts

According to a new report women entrepreneurs still face significant obstacles starting and running a small business.

The commitment required to apply for a business loan may have you on the fence, unsure of whether or not to move forward. You’re not wrong to be cautious

Consumers are being urged to monitor and lock or freeze their credit profile, but how should small business owners respond? Will a freeze impact a business?

Man in the middle scams are on the rise, and art galleries and dealers have emerged as high value targets for this cyber crime.

In this post we outline best practices for establishing business credit. Just because you have a business, don’t assume you have a business credit score.

Entrepreneurs familiar with innovative financing are beginning to turn to crowdfunding for small business disaster recovery.

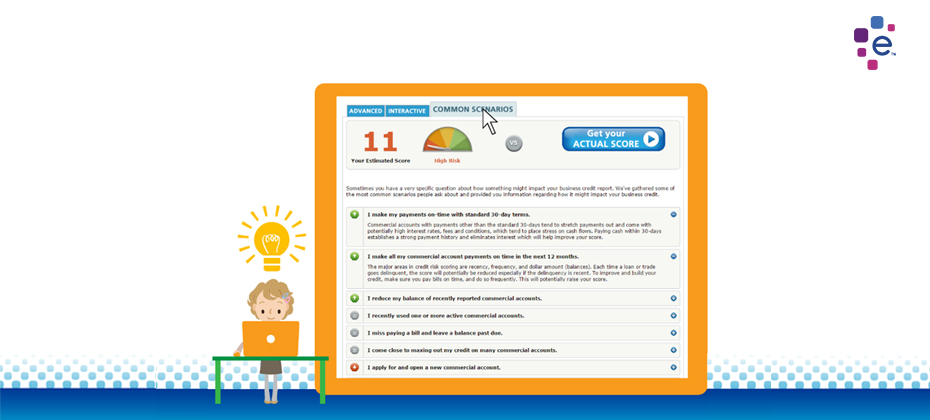

Experian has released a business credit score planner tool to help you run what-if scenarios. It helps you learn behaviors that build strong credit.

Be aware of scam artists, and protect your business from fraud during natural disaster recovery.

See the results of a Small Business Administration study of veteran owned businesses’ impact on the US economy.