At A Glance

Infillion and Experian collaborate to help advertisers connect with audiences across devices and channels, as cookies and mobile identifiers disappear. By integrating Experian's Digital Graph and Offline Identity Resolution, Infillion strengthens identity connections, improves campaign reach, and enhances audience engagement across CTV, mobile, and web.In our Ask the Expert Series, we interview leaders from our partner organizations who are helping lead their brands to new heights in AdTech. Today’s interview is with Ben Smith, VP of Product, Data Products at Infillion.

Adapting to signal loss

What does the Experian–Infillion integration mean for advertisers looking to reach audiences as signals fade?

As cookies and mobile identifiers disappear, brands need a new way to find and reach their audiences. The Experian integration strengthens Infillion’s XGraph, a cookieless, interoperable identity graph that supports all major ID frameworks, unifying people and households across devices with privacy compliance, by providing a stronger identity foundation with household- and person-level data. This allows us to connect the dots deterministically and compliantly across devices and channels, including connected TV (CTV). The result is better match rates on your first-party data, more scalable reach in cookieless environments, and more effective frequency management across every screen.

Connecting audiences across channels

How does Experian’s Digital Graph strengthen Infillion’s ability to deliver addressable media across channels like CTV and mobile?

Experian strengthens the household spine of XGraph, which means we can accurately connect CTV impressions to the people and devices in that home – then extend those connections to mobile and web. This lets us plan, activate, and measure campaigns at the right level: household for CTV, and person or device for mobile and web. The outcome is smarter reach, less waste from over-frequency, and campaigns that truly work together across channels.

The value of earned attention

Infillion has long championed “guaranteed attention” in advertising. How does that philosophy translate into measurable outcomes for brands?

Our engagement formats, such as TrueX, are based on a simple principle: attention should be earned, not forced. Viewers choose to engage with the ad and complete an action, which means every impression represents real, voluntary attention rather than passive exposure. Because of that, we consistently see stronger completion rates, deeper engagement, and clearer downstream results – like lower acquisition costs, improved on-site behavior, and measurable brand lift.

To take that a step further, we measure attention through UpLift, our real-time brand lift tool. UpLift helps quantify how exposure to a campaign influences awareness, consideration, or purchase intent, providing a more complete picture of how earned attention translates into business impact.

Creative innovation and location insights

Beyond identity resolution, what are some of Infillion’s capabilities, like advanced creative formats or location-based insights, that set you apart in the market?

One key area is location intelligence, which combines privacy-safe geospatial insights with location-based targeting through our proprietary geofencing technology. This allows us to build custom, data-driven campaigns that connect media exposure to real-world outcomes – like store visits and dwell time – measured through Arrival, our in-house footfall attribution product.

We also build custom audiences using a mix of zero-party survey data, first-party location-based segments, and bespoke audience builds aligned to each advertiser’s specific strategy.

Then there’s creative innovation, which is a major differentiator for us. Our high-impact formats go beyond static display, such as interactive video units that let viewers explore products through hotspots or carousels, rich-media ads that feature polls, quizzes, dynamic distance, or gamified elements, and immersive experiences that encourage active participation rather than passive viewing. These creative formats not only capture attention but also generate deeper engagement and stronger performance for a variety of KPIs.

Future ready media strategies

How does Infillion’s ID-agnostic approach help brands future-proof their media strategies amid ongoing privacy and tech changes?

We don’t put all our eggs in one basket. XGraph securely unifies multiple durable identifiers alongside our proprietary TrueX supply to strengthen CTV household reach. This agnostic design allows us to adapt as platforms, regulations, and browsers evolve – so you can preserve reach and measurement capabilities without getting locked into a single ID or losing coverage when the next signal deprecates.

Raising the bar for media accountability

Looking ahead, how is Infillion evolving its platform to meet the next wave of challenges in audience engagement and media accountability?

From an engagement standpoint, we’re expanding our ability to support the full customer journey, offering ad experiences that move seamlessly from awareness to consideration to conversion. That includes smarter creative that adapts to context, intelligent targeting and retargeting informed by real data, and formats designed to drive measurable outcomes rather than just impressions.

When it comes to accountability, we’re ensuring that measurement is both flexible and credible. In addition to our proprietary tools, we partner with leading third-party measurement providers to validate results and give advertisers confidence that their investment is truly performing. Within our DSP, we emphasize full transparency and log-level data access, ensuring advertisers can see exactly what’s happening on every impression.

All of this builds toward the next era of agentic media buying – one enabled by our MCP suite and modular, component-based tools. This evolution brings greater accountability and next-generation audience engagement to an increasingly automated, intelligent media landscape. Our goal is to help brands connect more meaningfully with audiences while holding every impression – and every outcome – to a higher standard of transparency and effectiveness.

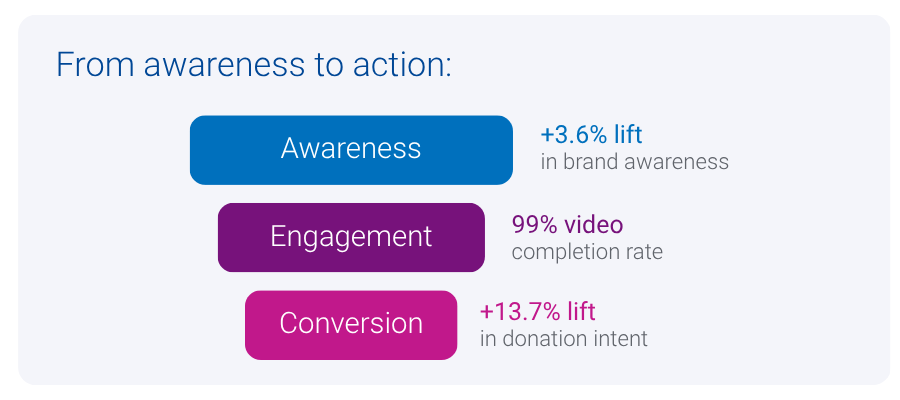

Driving impact across the funnel

What is a success story or use cases that demonstrate the impact of the Experian–Infillion integration?

We recently partnered with a national veterans’ organization to raise awareness of its programs for injured or ill veterans and their families. Using the Experian integration, we combined persistent household- and person-level identifiers with cross-device activation to reach veteran and donor audiences more precisely across CTV, display, and rich media. The campaign achieved standout results – industry-leading engagement rates, a 99% video completion rate, and measurable lifts in both brand awareness (3.6 % increase) and donation consideration (13.7% lift). It’s a clear example of how stronger identity and smarter activation can drive meaningful outcomes across the full funnel.

Contact us

Identity resolution FAQs

Identity resolution ensures accurate connections between devices, households, and individuals. Experian’s Offline Identity Resolution and Digital Graph strengthen these connections for improved targeting and consistent measurement across CTV, mobile, and web.

Solutions like Experian’s Digital Graph enable brands to connect first-party data to household and person-level identifiers, ensuring scalable reach and compliant audience targeting legacy signals fade.

Focusing on earned attention (where audiences actively choose to engage) leads to stronger completion rates, improves on-site behavior, and drives measurable increases in brand awareness and consideration.

By linking CTV impressions to households and extending those connections to mobile and web, Experian’s identity solutions ensure campaigns work together seamlessly, reducing over-frequency and improving overall reach.

About our expert

Ben Smith

VP Product, Data Products, Infillion

Ben Smith leads Infillion’s Data Products organization, delivering identity, audience, and measurement solutions across the platform. Previously, he was CEO and co-founder of Fysical, a location intelligence startup acquired by Infillion in 2019.

About Infillion

Infillion is the first fully composable advertising platform, built to solve the challenges of complexity, fragmentation, and opacity in the digital media ecosystem. With MediaMath at its core, Infillion’s modular approach enables advertisers to seamlessly integrate or independently deploy key components—including demand, data, creative, and supply. This flexibility allows brands, agencies, commerce and retail media networks, and resellers to create tailored, high-performance solutions without the constraints of traditional, all-or-nothing legacy systems.

Latest posts

Discover how Yieldmo utilizes Experian’s identity and audience data to drive personalized, omnichannel ad campaigns with precision, privacy, and measurable results.

Learn how the buy-side can use Experian’s advanced data and identity solutions to be their guide through the jungle and emerge as winners.

We spoke with industry leaders from Ampersand, Basis Technologies, Captify, Cuebiq, CvE, Fetch, Madhive, MiQ, and Samsung to gather insights on how innovations in data and identity are creating stronger consumer connections. Here are five key insights to consider. 1. Build on trust with first-party data Stricter privacy regulations and growing customer expectations mean businesses must rethink how they gather and use data. A robust first-party data strategy centers on gathering high-quality data, such as behavioral and transactional data. By using behavioral, lifestyle, and purchasing data, brands can craft personalized strategies that align with their goals. This approach balances effective targeting with building trust and complying with privacy rules. Integrating identity solutions like Unified I.D. 2.0 (UID2) and ID5 into existing data strategies improves interoperability across platforms while keeping user privacy intact. These tools help create more effective campaigns. "We've been preparing and leaning into educating our clients around the value of first-party data. These are very important and primary considerations in any of our campaigns."April Weeks, Basis Technologies 2. Align metrics with business goals To demonstrate clear value, campaigns need to tie their outcomes to broader goals. Relying only on click-through rates or CPMs won’t cut it. Metrics that measure meaningful results, like driving sales or increasing customer retention, provide greater transparency than surface level data, like clicks or impressions. A continuous feedback loop between targeting and measurement ensures campaigns can be refined to better align with business objectives. This feedback helps marketers understand who they are targeting and how those audiences are driving key business results. Shifting focus to metrics that resonate with stakeholders ensures that marketing efforts are evaluated based on their true contribution to the company's objectives. "The television industry has access to more data than ever before, and at Samsung Ads, our ACR technology helps us provide valuable insights about what content and ads are being viewed. This abundance of data enables us to support clients in aligning their campaigns with business objectives effectively."Justin Evans, Samsung Ads 3. Personalize experiences to boost engagement Personalization drives stronger customer relationships by delivering tailored experiences to individual customer needs. Using data-driven insights to fine-tune offers and messaging makes interactions more relevant, strengthening brand loyalty. Combining behavioral, lifestyle, and transactional data provides a comprehensive understanding of the customer journey and ensures each touchpoint feels personal. Testing and iterating on personalization strategies also helps identify which data and approaches yield the best results. Scaling these efforts means customers receive the right messaging at the right time, and businesses see better outcomes. "Every business should be building a data strategy that thinks about the different versions of data that exist and how they bring that together. They don't necessarily need to own all of it but have a clear rationale and strategy about where you're using which data sets."Paul Frampton, CvE 4. Utilize advanced measurement tools for smarter decisions Improving the effectiveness of campaigns starts with using sophisticated measurement tools to gain actionable insights. Using analytics like brand lift studies, foot traffic analysis, app download tracking, incrementality, and share of search allows marketers to understand the full impact of their efforts. With these resources, teams can pinpoint what’s working, make real-time adjustments, and refine their approach. This adaptability ensures budgets are used as effectively as possible. Learn how Swiss Sense measured marketing outcomes using Mosaic® "We are playing a leading role in democratizing new tools for local advertisers. By mimicking the marketing funnel mentality, we've introduced solutions ranging from measuring brand lift to tracking foot traffic and app downloads."Luc Dumont, Madhive 5. Adapt quickly to stay competitive The only constant in advertising is change. Adapting quickly to new technologies and consumer behaviors keeps businesses competitive. A culture of agility fosters innovation, making it easier to respond to industry shifts and discover new opportunities. Companies that anticipate change and invest in modern data solutions position themselves for long-term growth. Whether it’s adjusting to privacy updates, exploring emerging tech, or staying flexible, businesses must continuously invest in adapting their platforms and strategies. "Falling behind is not really an option. There's always a change in advertising and in data where there's a new horizon. The people who stay close to that and innovate will always follow it."Amelia Waddington, Captify Shaping the future Building meaningful consumer connections requires advertisers to combine robust data strategies with flexibility and innovation. By focusing on these five considerations, marketers can adapt to today’s challenges while preparing for what’s ahead. Connect with our experts Latest posts