Moving into the agentic era of fraud and credit risk decisioning

In the next five years, underwriting will change more than it has in the past two decades. That’s the clear message from Experian’s latest global study. Based on research with more than 700 senior decision-makers across 10 countries and over 70 expert interviews. The findings point to an underwriting future that is more automated, contextual, and seamlessly embedded into customer journeys.

But while technology is the enabler, the driving force is the consumer.

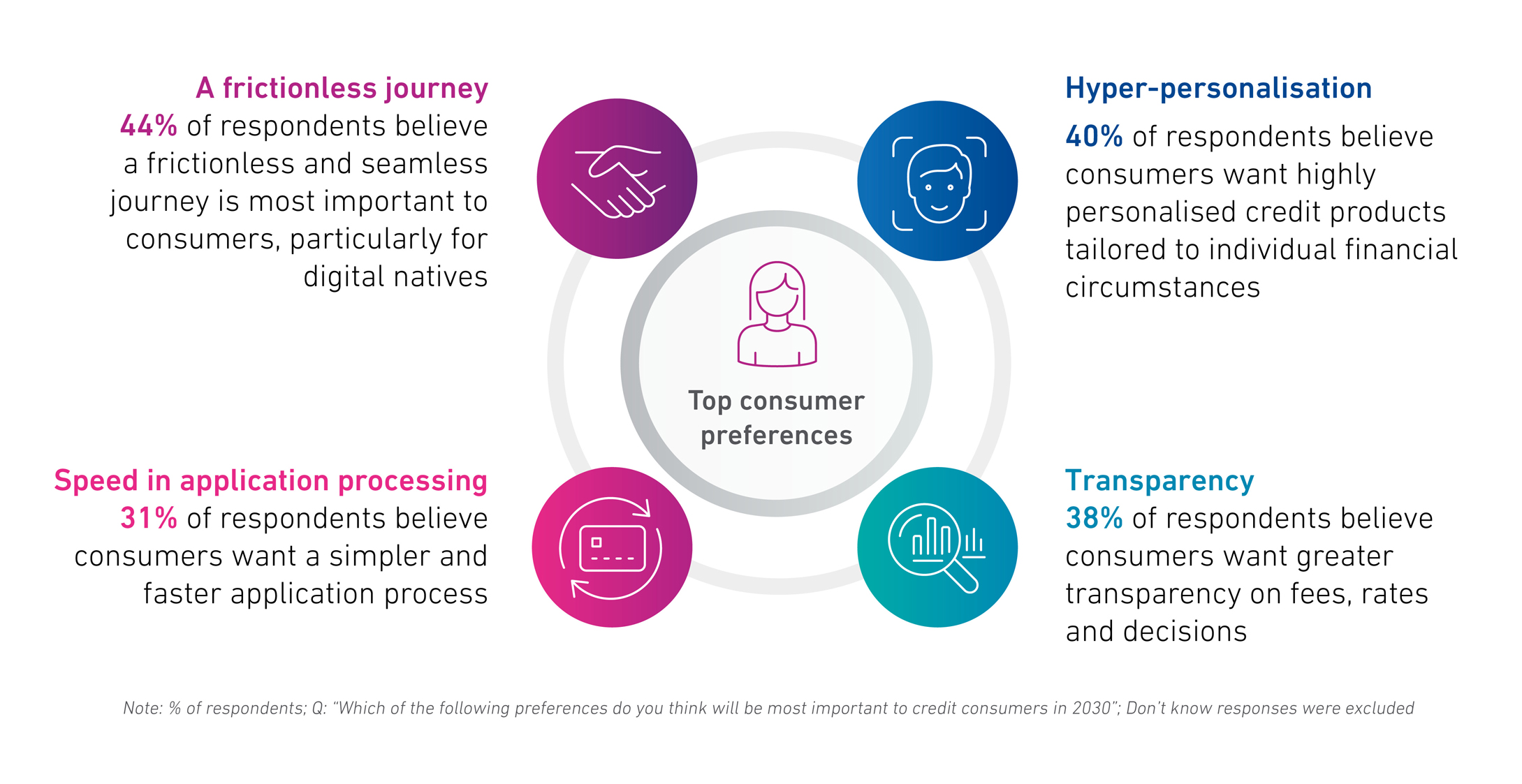

Consumers want more, and technology is heightening expectations

Today’s consumers want credit experiences that are faster, more transparent, and tailored to their real financial lives. Over 40% of respondents told us that a frictionless borrowing experience is now the top priority for consumers, especially younger generations. They’re no longer willing to tolerate difficult journeys, unclear terms, or long waits for a decision.

This means underwriting can no longer remain a back-office function. It must become a front-line service that operates in real time, embedded within digital channels. Already, 83% of industry leaders expect lending to become an embedded part of commercial transactions, not a standalone product.

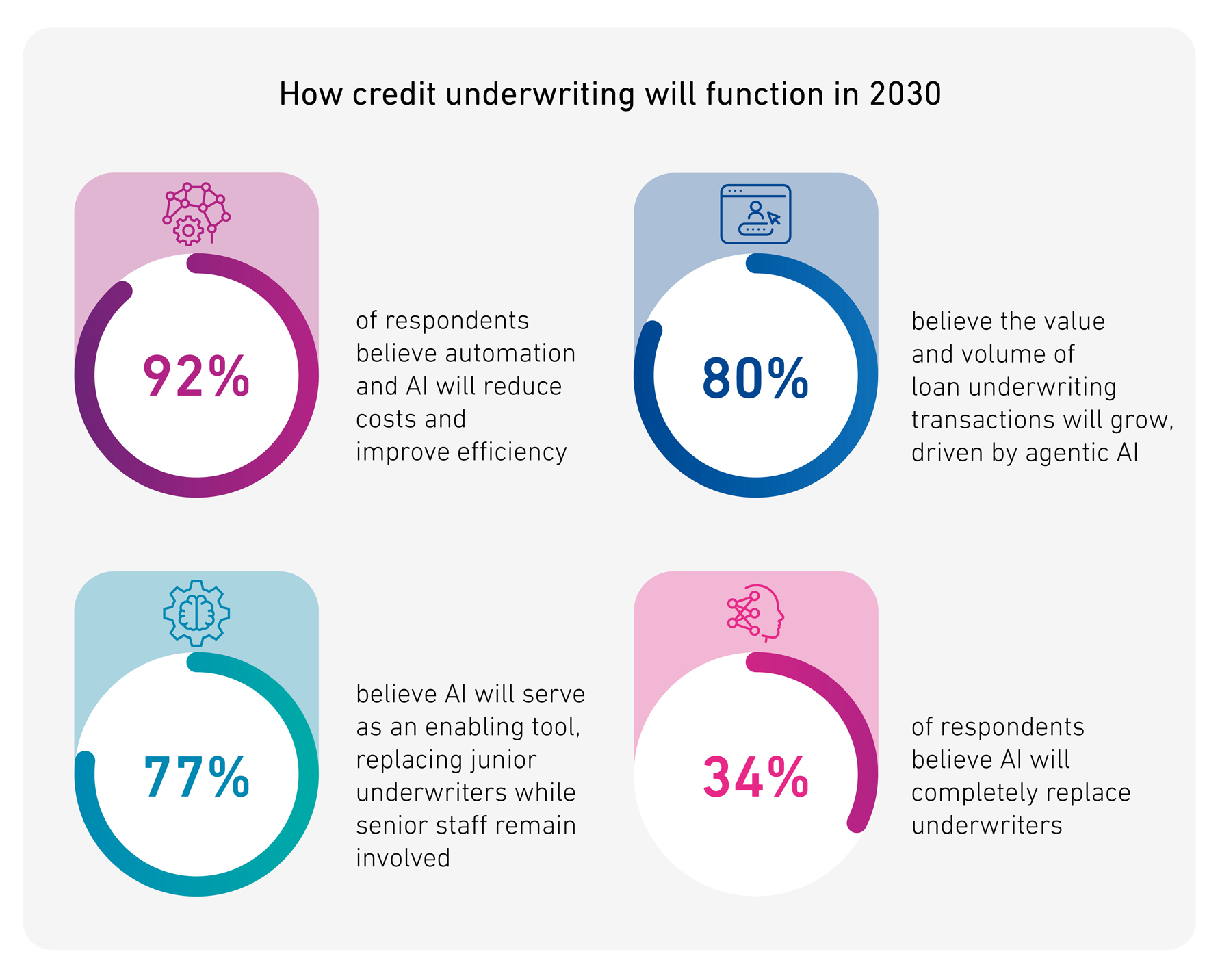

Technology is transforming how risk is assessed

Automation and AI are changing how we assess risk and make decisions. But crucially, most experts do not expect AI to fully replace human underwriters. Instead, AI is seen as an enabling tool, handling lower-ticket cases at scale, while humans remain essential in high-value or complex decisions.

What is changing is the scale and speed. By 2030, decisions will increasingly be powered by agentic AI – digital agents that act on behalf of customers to compare products, submit applications, and verify identity. This will radically simplify the journey but will also mean that businesses must rethink how they secure trust and verify identity in a world of invisible interactions.

Alternative data is essential, but orchestration is the key

More data is available now than ever before, but access alone is not enough. The winners in 2030 will be those who can orchestrate data in real time, from traditional credit files to behavioural, open banking, and synthetic sources, to build a holistic, explainable view of each customer.

In fact, 80% of respondents expect to rely more on alternative data than traditional sources by the end of the decade. This shift will improve credit inclusion and model precision, but also demands investment in platforms that can ingest and manage data with full transparency.

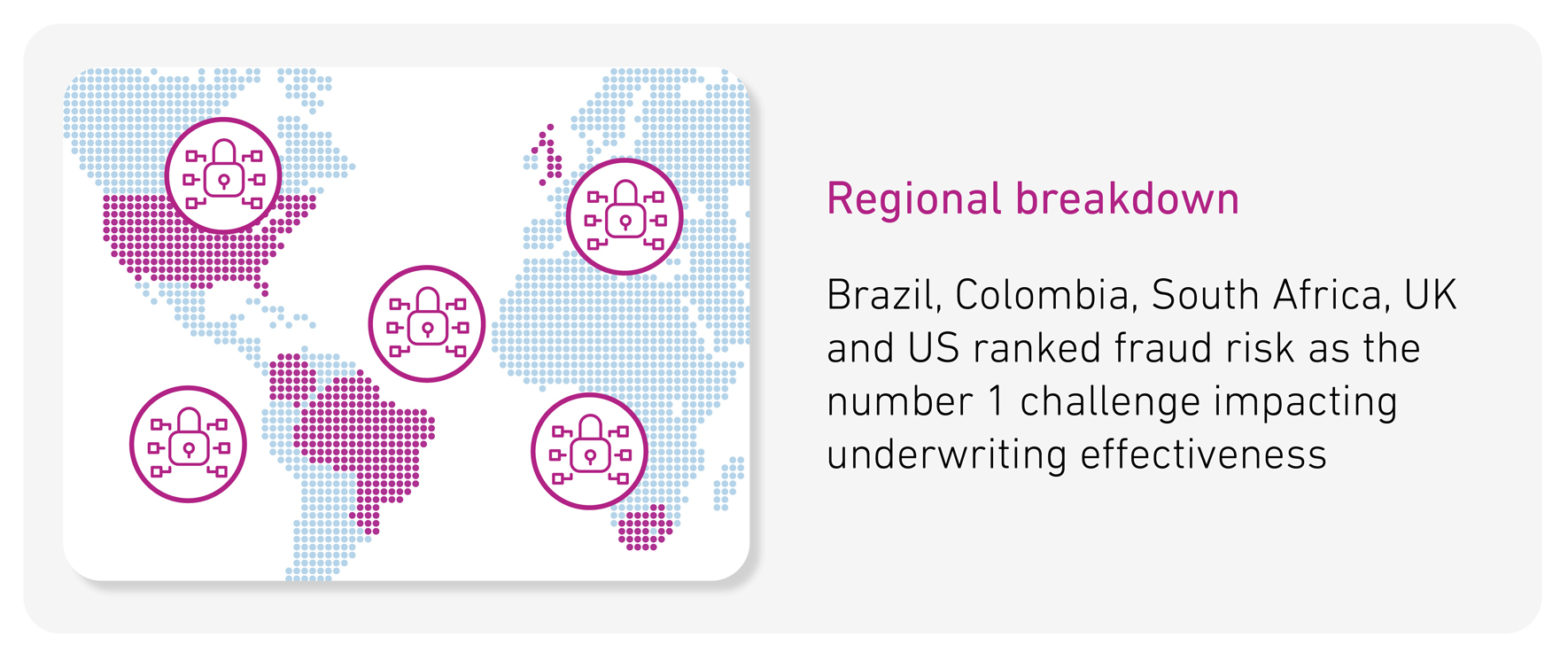

Fraud is not going away

As underwriting becomes more seamless, the traditional touchpoints for fraud detection start to disappear. In low-friction journeys, fraud doesn’t vanish; it hides. That’s why 94% of leaders told us that cybersecurity and fraud prevention will remain a top priority into the next decade.

Trust will need to be embedded into the journey with dynamic risk signals, behavioural biometrics, and AI-based identity verification working in the background to spot anomalies and synthetic profiles. Risk and fraud functions, once siloed, are now converging.

What should businesses do now?

The insight from this research is clear: businesses must evolve their approach to underwriting to better tackle a rapidly evolving environment. Here are the five priorities to focus on now:

- Invest in orchestration: Data access alone isn’t enough. Tools must connect, validate, and use alternative, behavioural and consented data in real time.

- Embed trust: Adopt continuous risk monitoring, robust digital identity, and explainable models to ensure fraud is detected and decisions remain accountable.

- Ensure platform-readiness : Cloud-native, API-first architecture will be essential for agility, scalability and compliance.

- Rethink human contribution: The role of the underwriter will shift from manual decision-making to exception handling, oversight, and governance. Train staff for exception handling, oversight, and governance, not manual processing.

- Adopt a partnership mindset: Success will depend on building and managing high-performing ecosystems and leveraging trusted partners for infrastructure, insights, and innovation.

Want to lead in 2030?