The credit landscape is undergoing a seismic shift.

Consumers expect seamless, lightning-fast digital experiences, but financial institutions must also contend with rising fraud risks and intensifying regulatory pressure. Incremental tweaks won’t cut it – modern lending demands a radical rethink.

In an era defined by AI, automation and data-driven insights, lenders have a unique opportunity: to transform credit operations from rigid and reaction, to agile, intelligent and scalable.

When presenting our research, I’m often challenged to provide evidence of companies that have made this move and embraced this shift, not just to survive, but to lead. “What benefits did they actually see – in dollars and cents?” It’s a fair question, especially when the stakes are high and the path forward can seem uncertain.

To answer it, Experian commissioned Forrester Consulting to conduct a Total Economic Impact™ study on the impact of Experian Ascend Platform with organisations that have made this move. The findings showcase how lending institutions are leveraging advanced analytics and automation to enhance credit operations, reduce fraud, and accelerate business growth.

The need for accurate and efficient credit operations has never been greater

The challenges financial institutions face today:

- Manual, slow credit decisioning: Lengthy approval processes limit scalability and impact customer satisfaction.

- Lack of up-to-date data: On-premises environments can prevent accurate up-to-date data. Static scorecards and manual checks happen after the fact.

- Inconsistent underwriting decisions: Manual assessments introduce bias and inefficiencies.

- Rising fraud risks: The financial ecosystem faces increasing fraud threats that require real-time detection.

- Market volatility: Institutions must adapt faster to economic changes and regulatory requirements.

Key findings from Forrester Total Economic Impact™ of Experian Ascend Platform

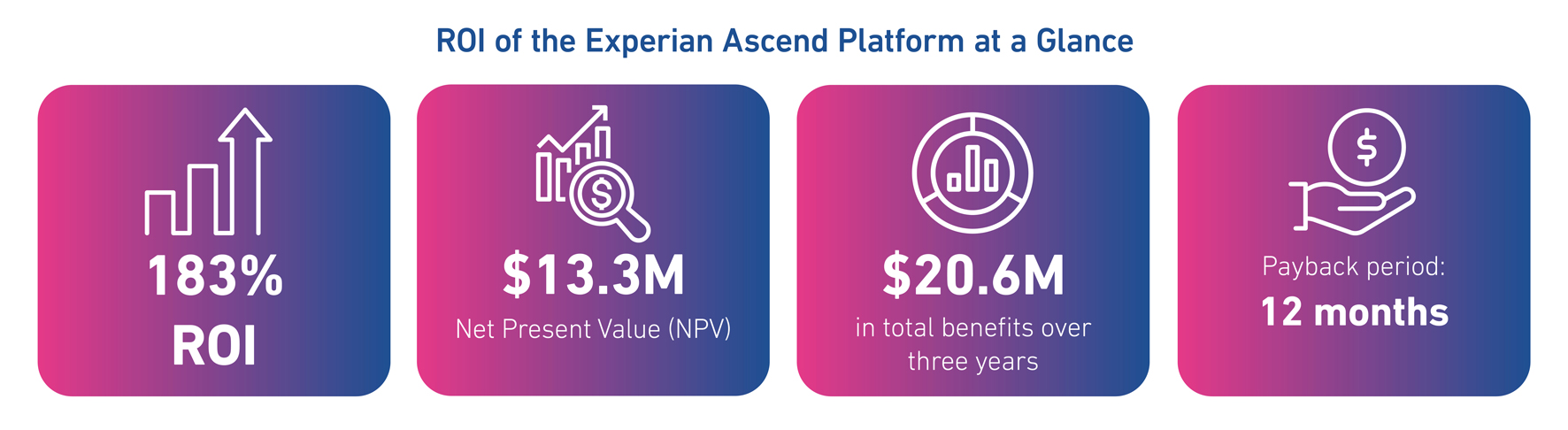

Forrester’s independent research provides quantifiable insights into the financial impact of Experian Ascend Platform. The results are based on a composite organisation representative of interviewed customers over three years.

- 183% ROI with a $13.3M Net Present Value (NPV)

- 12-month payback period

- 12% improvement in approval rates over three years

- 5% year-over-year in new revenue from additional applications

- 67% efficiency gains in credit decisioning

- 20% reduction in default costs

These numbers show institutions investing in Experian Ascend Platform see rapid, measurable returns.

Real-world impact: How businesses are benefiting

In addition to the data, the study includes real customer successes across industries:

Car leasing company: Increased approval rates from 60% to 66%, leading to better risk management and higher conversion rates.

Global airline: Reduced fraud chargebacks by 99.9% (from 6,660 cases per year to just 4), preventing financial losses and reputational damage.

Fintech lender: Reduced model development time from months to days, improving agility in risk assessment.

These organisations transformed their operations by replacing legacy systems with cloud-based, automation and advanced analytics that deliver real-time insights and consistent, scalable decision-making.

“Experian Ascend Platform is driving revenue because more business is being accepted on an automated basis. It’s taking the decision away from the underwriters – making decisioning more consistent – and we are seeing less revenue erosion through successful fraud reporting.”

Credit Manager, Car Leasing

How the Forrester Total Economic Impact™ study can help your business

Financial leaders can use the Forrester Total Economic Impact™ of Experian Ascend Platform as a strategic decision-making tool to:

- Explore ROI potential: Start with the specific areas your business could benefit from using the Experian Ascend Platform, such as operational efficiency, faster decisions, or marketing effectiveness.

- Build a business case that resonates: Back your investment with proven results. Use real-world success metrics from organisations like yours to shape a compelling, data-driven case.

- Uncover new growth opportunities: Think beyond cost savings and efficiency gains. With automation and advanced analytics, there’s real potential to expand your portfolio, enter new markets, and deepen customer engagement.

- Mitigate risk with confidence: See how other businesses have successfully reduced fraud, defaults, and compliance risk.

This study provides a data-driven framework to help financial institutions understand the value added to their business.

Download the full Forrester Total Economic Impact™ of Experian Ascend Platform study to explore the potential financial impact on your business.