New IDC MarketScape: Worldwide Enterprise Fraud Solutions 2024 Vendor assessment provides valuable resource as organizations face increased fraud.

With fraud scam losses reported to have reached $10bn in 2023*, preventing fraud in today’s digital landscape has become increasingly complex. As organizations continue to leverage advanced technologies, fraudsters have also evolved, employing ever more sophisticated techniques. Striking the balance between robust fraud prevention and delivering a seamless digital experience to customers has become a priority for organizations, with customer experience (CX) proving to be a competitive differentiator in a market with high digital expectations.

Why real-time detection matters for CX

As techniques employed by fraudsters get faster, so does the need for quick and effective fraud detection, making real-time solutions increasingly important during a period of rapid technological advancement. The development of real-time fraud solutions not only minimizes financial losses, but it has also paved the way for frictionless customer journeys, with identity and fraud checks no longer impeding customer experience.

Using machine learning to leverage data and enable fraud detection

To enable real-time detection, proactive fraud prevention also requires the analysis of vast amounts of data. Deploying static rules to identify anomalies in data does not allow for nuance because the thresholds within the rules are fixed, and therefore real-time patterns cannot be adjusted to within the model. Machine learning not only allows businesses to leverage data more effectively through analysis, allowing for flexibility within the parameters, but it also removes some manual processes, improving efficiency by updating models faster into production.

Approving good customers is the number one priority for businesses, and a frictionless digital customer journey is the catalyst for this. To minimize financial losses while reducing the overall number of fraud incidents, organizations are looking to real-time fraud detection, enabled by machine learning.

“As fraud risk losses continue to increase, the pursuit of fraud risk management solutions designed to identify, mitigate, and prevent fraud incidents and losses is a topic with increasing focus within financial services.”

Sean O’Malley, research director, IDC Financial Insights: Worldwide Compliance, Fraud and Risk Analytics Strategies

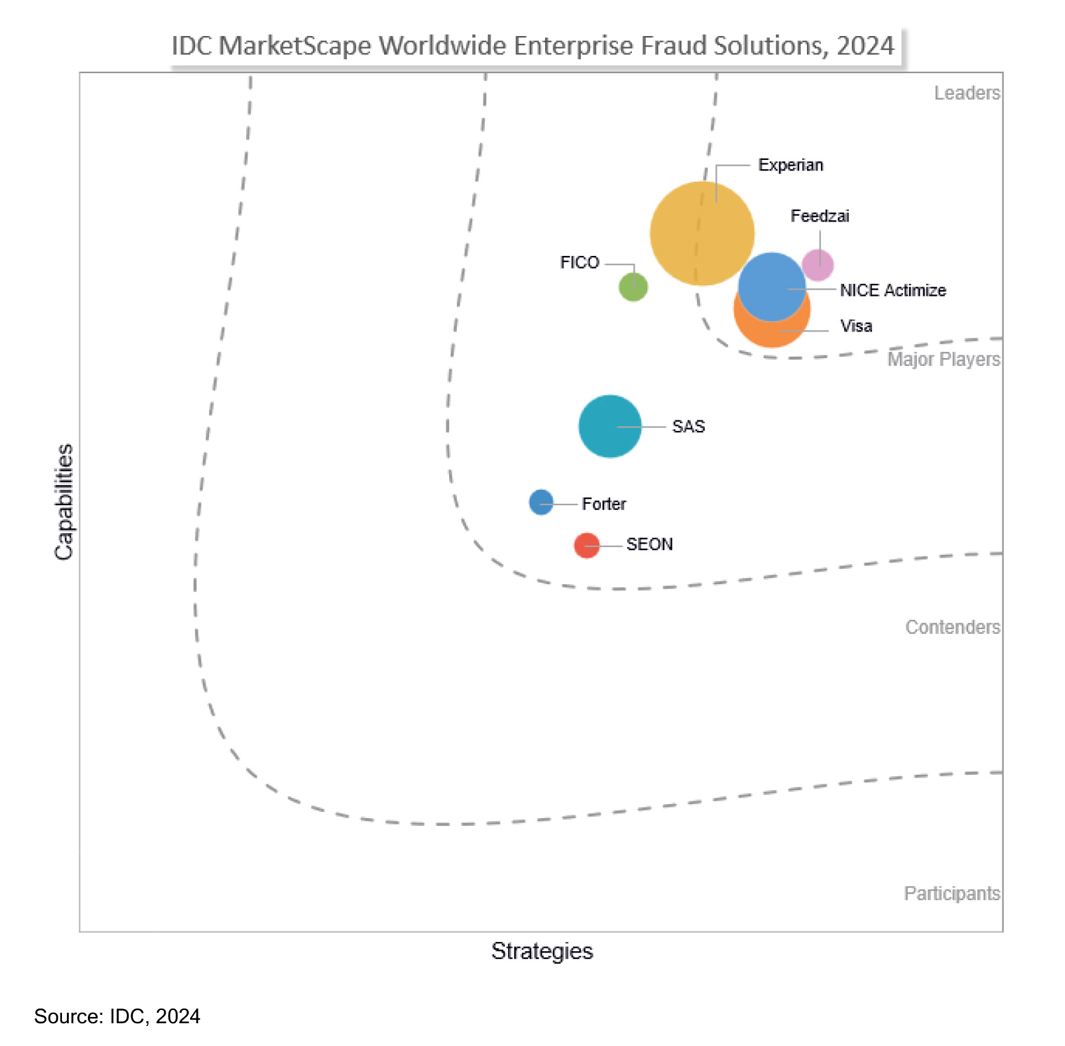

IDC, the premier global market intelligence firm, released its latest IDC MarketScape: Worldwide Enterprise Fraud Solutions, providing a valuable resource to buyers looking for new solutions in the market.

Download excerpt of IDC MarketScape: Worldwide Enterprise Fraud Solutions 2024 Vendor Assessment

The report highlights:

Fraud solutions are increasingly moving toward real-time fraud detection and prevention.

There are significant enhancements in technological capabilities, particularly with respect to cloud computing.

Some newer fraud solutions take advantage of the increased computing power that is available to both expand the data sets being used to identify potential fraud incidents and enhance the models designed to detect, mitigate, and prevent fraud.

Experian is recognized as a leader in this report. The IDC MarketScape notes, “In addition to evaluating the transactional data for potential fraud, Experian’s CrossCore solution includes identity-authentication tools. The solution uses identity data, device intelligence, email and phone intelligence, alternative identity data, biometrics, behavioral biometrics, one-time passwords, and document verification to confirm identities and aid with identity protection, including synthetic identity protection. Experian utilizes multiple data partnerships in its fraud solution, which often can help provide a more comprehensive understanding of fraud risks and exposures.”

To achieve a frictionless and secure customer experience, it is the integration of digital identity and fraud risk that is creating a gold standard for businesses. A siloed approach to fraud prevention not only leaves gaps for criminals to exploit, but it also presents consequences for customer experience too.

The ability to layer multiple fraud capabilities together in a synchronized effort to achieve the best analytics-driven output possible can allow businesses to have the flexibility within their user journeys to optimize and control the order in which capabilities are called, removing friction, and ensuring good customers are successfully onboarded. Add in a final layer of machine learning to ensure the deployment of unified decisioning, and businesses are left with cohesive and explainable decisions.

At Experian, we are working diligently to stay on the cutting edge of fraud and identity. In addition to our proprietary credit data on over 1.5 billion consumers and over 200 million businesses, Experian leverages a unique curated partner ecosystem to provide a more comprehensive understanding of fraud risks and exposures. Our powerful technology platform enables users to leverage a wide range of tools to combat their customized fraud challenges.

*IDC MarketScape: Worldwide Enterprise Fraud Solutions 2024 Vendor Assessment