Strategies to Pay Off Student Loan Debt Faster

The average 2016 grad holds $37,172 in student loan debt — which is why we hosted a special #CreditChat on Periscope, Blab, Twitter, and Snapchat to discuss ways to manage and eliminate college debt.

Our featured guest on Twitter was: Wayne Weber, CEO of Gift of College

The video panel included: Andrew Josuweit: CEO of StudentLoanHero.com; Shannon McNay: Director of Content at MyBankTracker.com; Rod Griffin: Director of Public Education at Experian; Mike Delgado:Director of Social Media at Experian.

We also featured student loan pay off tips on Snapchat with 4 Strategic Ways to Pay Off Student Loan Debt Faster.

Here are some tips we discussed in more detail …

Strategies to Help You Pay Down Student Loans Faster

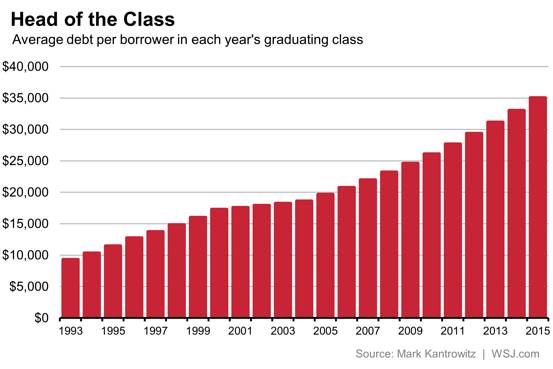

Paying back student loans is a lot of work — and especially difficult if you’re living paycheck-to-paycheck. Right now, the average 2016 grad holds $37,172 in student loan debt, which continues the trend of increased debt per borrower every year:  Here are some suggestions for helping you manage (and pay off) student loans:

Here are some suggestions for helping you manage (and pay off) student loans:

1. Paying down student debt strategically begins by knowing details about each loan

The first step to building a strategy to paying down student loan debt is knowing how much you owe across all your different loans. If you’re unsure of how many loans you have, go to the National Student Loan Data System for info on your federal student loans. To track your private student loans, check your credit reports to ensure you know each of your lenders. Remember, student loans are reported on credit reports so ensure you pay all loan bills on time to avoid hurting your credit scores. As you collect info about each of your student loans, make a list to track:

- Type of Loan (Federal or Private)

- Fixed-Rate or Variable-Rate

- Balance

- Interest Rates

- Term Length

- Total Due (w/ Interest)

- Grace Period (Interest Accrues)

Knowing these details can help you figure out what loans are costing you the most — and how to approach which loan you want to focus on paying off first. The Office of the U.S. Department of Education provides some helpful calculators to help you understand your loan terms and repayment estimation.

2. Know the pros and cons of refinancing (or consolidating) student loans to lower your monthly payment

After knowing details about each of your loans, you might be tempted to consolidate (or refinance high-interest rate student loans) into another loan program. Refinancing can help you lower your monthly payments, but can also increase the term length and interest rates. You will also lose your federal borrower benefits (e.g. grace period, Perkins loan forgiveness, federal loan protections, etc). Consolidation or refinancing your student loans can be a great option for you — just know how it will impact you financially.

3. Make bi-weekly student loan payments to save money on interest

“Paying half your student loan payment every two weeks works out to a full extra payment a year,” says Betsy Mayotte at the American Student Assistance (ASA). And you’ll also save money on the total interest you’d be paying. Check out this helpful calculator to see how much you can save by making bi-weekly payments. The key is to ensure you’re making both payments before the due date.

4. Sign-up for automatic payments to earn an interest rate reduction by around .25%

Many lenders are offering a small reduction in interest rates simply by signing up for automatic payments. Typically, a lender will discount your interest rate by .25%. Signing up for direct deposit not only lowers the cost of your total loan, but also ensures you won’t miss a payment (which is key for improving your credit scores).

5. Ensure that any over payments you make are used to cut down your principal

The swiftest way to cut down your student loan debt is to make payments against your principal balance. If you want to make bigger payments on your loan, just make sure your lender is informed to use that payment to your principal. Sometimes lenders need to be instructed to do this.

6. Stay motivated to pay off student loans by focusing on eliminating one loan at a time

When you have several student loans to pay off, it’s easy to get overwhelmed and stressed out. This is why it’s important to get hyper-focused on eliminating one loan at a time. This means making minimum payments on all your student loans — but making additional payments on one particular loan. As you begin cutting down the principal balance, celebrate every win (e.g. each time you knock of $1,000).  To learn more, don’t miss our #CreditChat on Wednesday at 3 p.m. ET

To learn more, don’t miss our #CreditChat on Wednesday at 3 p.m. ET

Questions We Discussed:

- Q1: What mistakes are easy to make when applying for college loans?

- Q2: How can students keep college costs down?

- Q3: Where can college students learn about scholarships and grants available?

- Q4: What are differences between federal and private student loans?

- Q5: What are steps to take when ready to tackle college loan debt?

- Q6: How soon should you start paying down college loan debts? How?

- Q7: How do you determine what college loans to pay off first?

- Q8: What are pros/cons of student loan consolidation programs?

- Q9: What should students do if they are struggling to make their loan payments?

- Q10: Any final tips to help our community to pay off their student loans?

View the Entire Discussion via Storify

Join our #CreditChat every Wednesday at 3p.m. ET on Twitter and Google Hangouts. If you’ve never heard about #CreditChat, here is a brief overview:

Resources:

- 8 Surprising Ways to Pay Off Your Student Loan Debts Faster via Wisebread

- Student Loan Calculators via Student Loan Hero

- Complete List of Student Loan Forgiveness Programs & Options via Student Loan Hero

- Guide to Paying Off Student Loans Faster via Student Loan Hero

- Complete Guide to Refinancing Your Student Loans via LifeHacker