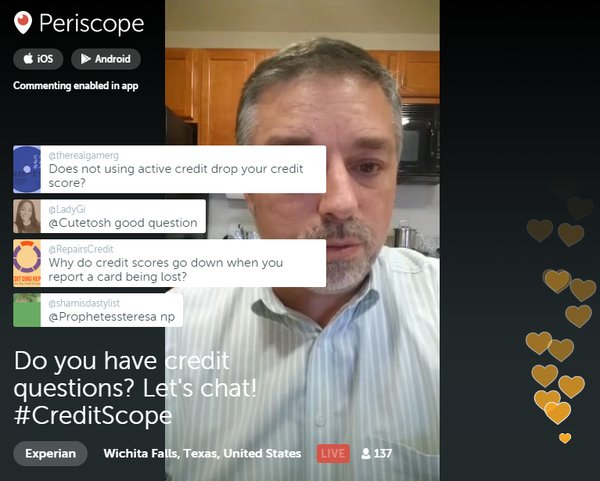

Does Not Using Active Credit Drop Your Score? #CreditScope

Do you have questions about credit?

Join our live video chat every Tuesday and Thursday at 2:30 p.m. ET on Periscope. Rod Griffin, Director of Public Education at Experian, is available to answer your questions live.

Here are some of the key questions Rod addressed in today’s scope:

Will bankruptcies come off my report automatically?

Yes, bankruptcies will come off your credit report. A Chapter 13 bankruptcy will remain on your report for 7 years and a Chapter 7 bankruptcy will remain on your report 10 years from the filing date, respectively. The bankruptcy public records should come off automatically at the end of that period of time. You should also check your credit report to ensure the accounts that are part of the bankruptcy show a status of included in bankruptcy. If they don’t, send Experian your schedule A, which lists the accounts in the bankruptcy filing, and Experian will be able update them accordingly.

Does not using active credit drop your score?

Not using credit cards if you have them, in and of itself, won’t cause your credit score to drop. But in order for them to be included in a score there needs to be active credit use for at least three to six months. You need to use the credit card so there is information about how you manage the account in order to make a lending risk decision. It’s best to make a small purchase on your credit card and pay it in full each month to show activity and help build credit history.

Why didn’t my score move when I paid my car off?

Often times when you pay off a debt or a loan, your scores may initially drop because there is a change in your history and it is unclear whether that change indicates risk. However, in a few billing cycles, the scores typically will bounce back up. There may be other issues in your credit history such as high balances on credit cards or late payments, which would be offsetting the paid off vehicle, but that’s purely a guess without seeing the credit history. You can find out exactly what is going on by purchasing a credit score and looking at the risk factors provided with it. Those factors will tell you exactly what affected the score.

What are secured credit cards?

Secured credit cards are credit cards that are tied to a savings account. The credit limit of the account can be a percentage of the savings account or the full balance of the account. Tying the credit card to a savings account protects the lender. If you don’t pay the bill on time, the money you owe can be withdrawn from the savings account.

How can I improve my credit score?

There are three things that are most important when you want to improve your score. First, make all of your payments on time, every single time. That is the most important factor to credit scores.

The second most important factor is utilization. Make sure to keep your balances low on your credit cards and try to keep your utilization rate (balance-to-limit ratio) under 30 percent. You want your balances to be less than 30 percent of all of your credit cards combined as well as on any one card.

The third factor is time. Credit scores look at how you manage your credit over time, not just what the payment history is at the moment.

Check out the scope to hear answers to all the questions asked today, and scroll down to see Rod’s responses to a few unanswered questions:

How long does a foreclosure hurt you?

A foreclosure remains on your credit report seven years from the original delinquency date of the mortgage account, so it will have a long-term effect on our creditworthiness. But, because the negative information is deleted eventually, you can rebuild your creditworthiness if you take control of your debts and build a history of positive payments that will continue to appear after the foreclosure disappears.

How do I handle ID Theft?

If you suspect that someone may have obtained your identification information and is using it to commit identity fraud, contact Experian and request an initial security alert. The easiest way to add the alert is online at Experian’s online fraud center. You can also request the alert over the phone or by mail. At the same time, you can ask for a free copy of your credit report.

When you go to the online site, the “Add a fraud alert message” box will be checked. Simply click “Continue” and follow the instructions to instantly add a fraud alert and request a free credit report.

Experian will notify the other two credit reporting companies, and they will add an alert to their files as well.

The initial security alert remains for 90 days. It notifies anyone looking at your report that you may be a victim of identity theft and that someone may be trying to apply for credit in your name. The Fair Credit Reporting Act requires creditors to take reasonable steps in response to the alert to verify your identity before approving any requests made in your name. You will have the option to add a phone number to the alert so that creditors may contact you if someone applies for credit.

Can you explain FCRA?

The Fair Credit Reporting Act (“FCRA”) is the federal law that regulates the credit reporting industry. It specifies the responsibilities of the credit reporting companies, other consumer reporting companies, businesses that report information to them or use information from them and your rights as a consumer. For example, it is the law that provides for a free copy of your credit report once every 12 months. It also limits who can get a copy of your credit report and under what circumstances.

Scoped on: 02/09/2016