Small Business Matters is written and managed by the Experian Small Business team. Subscribe for business credit education, expert advice, and helpful articles to build a strong knowledge of business credit so you can scale and grow your business.

Business Credit Reports & Scores

Your business has a credit score too and it can be pivotal to your success. Learn more about building strong business credit.

Read moreCustomer Testimonials

Hear what Experian small business customers have to say about our credit report subscriptions; and the difference it makes.

View TestimonialsNews & Research

Stay ahead of the curve by being informed about industry trends and policies that impact small businesses.

Read moreThe latest from our experts

Experian Business Information Services is proud to stand in support of small businesses.

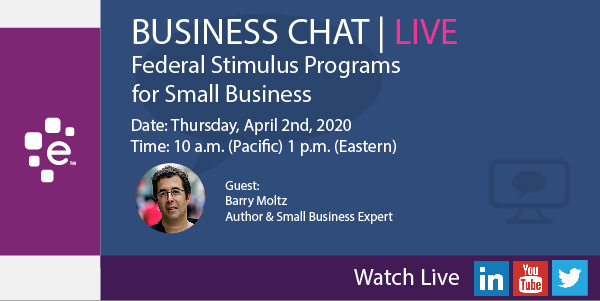

Join Experian Business Information Services and Barry Moltz on April 2nd. We will discuss federal small business stimulus programs.

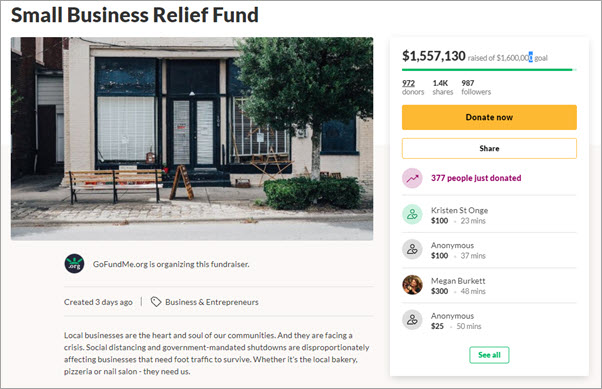

GoFundMe has set up a relief fund for businesses impacted but Covid-19. The goal of the fund is to raise $1.6 million for struggling businesses

We sat down with Stephanie Eidelman, the CEO of IA Institute, a media company that produces news, events, education for the credit and collections industry

Experian is partnering with the Federal Reserve to conduct its annual Small Business Credit Survey for both pre-start and existing businesses.

Stay competitive as an employer by being able to offer affordable health benefits to employees.

Experian spoke with women small business owners about how they use business credit for their business. Learn more about the Women in Business Study.

Here are some business credit answers on establishing and building a strong credit profile for your small business. Learn more at http://bit.ly/2ZNyRnV

In celebration of Women’s History Month, Yelp has started added a Women-owned Business attribute to their business profiles.