Getting the best deal when buying or selling your business

We focus in on the small business matter of buying or selling a business in our latest episode of the Small Business Matters podcast. We sit down with Accredited Senior Appraiser, Richard Goeldner with FairValue Advisors to learn helpful tips for getting the best deal.

Watch our interview

Key Takeaways:

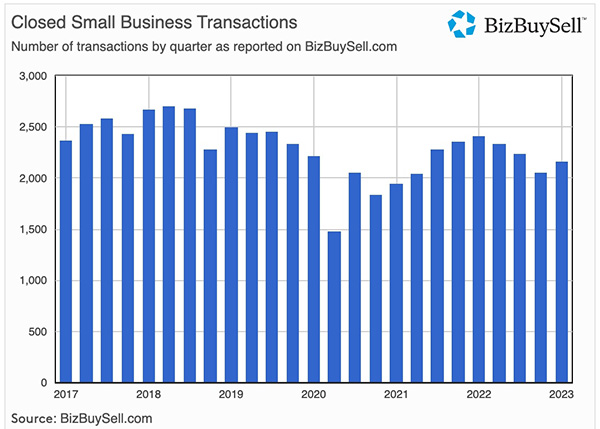

- Business acquisitions grew by 4.8% in Q1 2023, approaching pre-pandemic levels.

- When selling a business, lack of preparation and customer dependence are common mistakes that can reduce value.

- Valuing a business involves multiple methods, including cost-based, market-based, and income-based approaches.

- Factors that drive business value include revenue growth, profit margins, asset utilization, debt leverage, business risk, and market conditions.

- Learning from experts like Marcus Lemonis can provide insights into assessing the people, process, and product aspects of a business.

According to Biz Buy Sell’s Insight Report, a leading resource that tracks and analyzes businesses for sale, the number of business acquisitions grew in Q1 2023 by 4.8% of the prior quarter. And while this bounce follows three consecutive declines, the market for buying or selling a business has almost reached pre-pandemic levels.

Whether you’re buying or selling a business, value matters. So for this small business matter, we will be speaking with Richard Goeldner. He’s an Accredited Senior Appraiser who’s provided valuation advisory services since the early nineties, and he specializes in the valuation of privately held companies and tangible assets. He’s worked with Fortune 500 companies. Family businesses, middle market companies, as well as private equity firms, M&A firms, and the IRS and made numerous public appearances on the topic.

What follows is a lightly edited transcript of our interview:

Gary Stockton: Richard, welcome to Small Business Matters.

Richard Goeldner: Thanks Gary. Thanks for having me on.

Gary Stockton: With so many people taking the opportunity to quit their day jobs during the pandemic, are you seeing people buying or selling a businesses, or do you think they’re starting their own?

Richard Goeldner: I think that’s a, it’s a tough question. I certainly believe that they’re buying businesses starting businesses in this environment certainly, I think has been a challenge particularly given the economic conditions. Although, as you cited earlier, their, the conditions are improving in terms of business transaction activity.

Richard Goeldner ASP CBA CVA

“I would say lack of preparation is probably the biggest mistake in many smaller businesses the business is so dependent upon the owner, and if there isn’t a second level of management, a middle management, the risk to the buyer can be quite significant.”

Gary Stockton: For small business owners listening and who are considering buying or selling a business. What are some of the biggest mistakes that you see business owners making prior to a sale?

Richard Goeldner: Business owners, I would say lack of preparation is probably the biggest mistake in many smaller businesses the business is so dependent upon the owner, and if there isn’t a second level of management, a middle management, the risk to the buyer can be quite significant.

Because once that business is purchased, you know, are the customers going to stay? Are the employees going to stay? And oftentimes that owner is the glue that makes that business really stick. Putting plans in place and building out your management team well prior to selling your business, I think can certainly pay dividends.

Another area is customer dependence. If you have a business that is dependent upon one or two customers for, 30 to 50% of your revenue that’s gonna be viewed as significant risk to a potential buyer.

Gary Stockton: So you wanna really be building that business so that it can be assumed by somebody else. You don’t really want to have yourself so entangled with it, that it’s gonna fall apart whenever the sale is made. Is that what I’m hearing?

Richard Goeldner: Exactly. Exactly. And with those risks that translates into a lower price multiple and a low, usually a lower offer for the business or some kind of an earn out where the owner is obligated to stay on for a longer period of time to ensure a smooth transition. And of course, many business owners, the reason they’re selling their business is, I don’t wanna do it anymore. Again it can be a little problematic.

Gary Stockton: When I watch Shark Tank, as I’m sure you have, the Sharks always mentioned this formula for calculating business value. Can you explain that to us a little?

Richard Goeldner: Sure. Yeah. I love Shark Tank and I think one of the, one of the price multiples that they will bat around on the show is a multiple of revenues. And sometimes the numbers are really high 20 times a revenue. And most smart investors like the sharks, they’re really not buying revenues.

You can’t put revenues in your pocket. Investors are buying, the profits or the future cash flows of the business. And on Shark Tank, you’ll see that the sharks are jotting down notes in their little black notebooks, their little notepads, and we don’t get the benefit of seeing exactly what they’re thinking or what they’re jotting down.

But they’re probably estimating how long it’s gonna be until those businesses become stable and earn profits and they’re looking at discounting what that value might be for the risk and the amount of time needed to get that business to stabilization. Now, the example that I just went through is for a business that’s fairly young, and a lot of the businesses on Shark Tank are very young businesses.

There are times when a more mature business will come on Shark Tank for various reasons. And you’ll note that at that point the sharks are talking about a multiple of profits. EBITDA, for example, which is earnings before interest tax depreciation and amortization. It’s a profit measurement and they’ll be talking about a multiple of earnings.

And that’s more common in the valuation of businesses and in the sale of businesses. Again, unless you’re talking about ones that are more of a startup, of course. Also with the Sharks know that they have the backing of their name and their experience. So the businesses that they’re investing in generally have a greater chance of success as well.

Gary Stockton: Yeah. So what methods, when whenever you go into value a business or appraiser business, what methods are commonly used?

Richard Goeldner: Sure. There’s three approaches really which are similar to the approaches that are used in real estate appraisal. The first is a cost or asset based approach, which estimates what the business would be worth if liquidated. Think of the going out of business sale, turn out the lights, the party’s over. This approach gives very little value or no value to the goodwill of the business or the intangible assets like name, reputation, customer relationships, the existing personnel.

So the cost approach is typically appropriate for businesses that are in financial distress, where a buyer simply isn’t gonna pay more than what the hard assets are worth. So that’s approach number one. The second approach is a market approach. And we were talking about Shark Tank and multiples of revenue or profits. And that type of approach is a market approach where you’re estimating the value based on comparing the business to similar businesses that have sold. And this is frequently called the price multiple. Again, multiple of profits, which is really more popular than a multiple of revenue. And then the third approach is an income approach, which estimates the value by basically estimating the future profits and cash flow of the business in the future. How much could this business make annually? And then discounting those cash flows to a present value based on the risk involved in actually achieving those expectations. With this approach, I would say think of time value of money concepts. For healthy businesses, that market approach and that income approach are gonna be the most frequently used.

And of course, finding good data about businesses that have sold can be challenging. The market approach can be a little difficult at times. You could say that businesses that are unique can be very valuable. But businesses that are unique will probably not have very many comparable businesses that have sold.

Gary Stockton: So, what drives the value of a business?

Richard Goeldner: The I see really six factors that drive the value of a business. One is revenue growth. You have to have revenues to get the profits right? And profit margins, are they stable or improving? This is when I say profit margins, as a profits, as a percentage of revenue.

Is that stable or improving over the years? Asset utilization or asset usage, that’s our third key factor. You generally have to reinvest more of your profits in asset intensive businesses, these would be businesses that have perhaps, a lot of machinery equipment that needs to be replaced frequently. Those will tend to have a lower price multiple because you’re not able to take out as much of the profit into your pocket each year.

Then there’s debt leverage. Some business owners are. Very aggressive with the use of debt. They have too much of it, and some business owners elect not to use debt very much. And so for those that are very light on debt, that actually increases business value. And of course, those that are highly– have a real high debt level, you know, the value of the business is going to be lower. And then there’s business risk. This goes back to our conversation earlier about key person dependence or customer dependence. Those are examples of business risk that will impact value. And the last one, we really don’t have much control over, and that’s market conditions. Are we operating in an economic recession or perhaps in a growing economy? So clearly, having lived through the Covid recession, and I realize Covid’s still with us, but yeah, the economy has certainly bounced back.

But market conditions and the timing of that is really a factor that impacts value. But we really don’t have that much control over it.

Gary Stockton: Yeah. Marcus Lemonis from “The Profit,” he appears to have a sixth sense when it comes to valuing businesses. He’s looking to invest in. What do you think we could learn from him?

Richard Goeldner: I love Marcus. I love the show. He preaches People, Process and Product, and when he goes in to look at a business, usually one or more of those three issues, one or more are broken, either the people, the process or the product. And, if one of those three is broken, it depresses profits and obviously you end up with a business that could be in distress, and that’s where Marcus comes in.

So in many cases, Marcus finds the people relationships to be broken in some way. And so in many of his shows, you’ll see he’s trying to sort out the dynamics between family members and between employees. To see what the problems are from a people perspective and to see if he can fix those.

Sometimes he finds processes that are, inefficient or inconsistent, where the quality just isn’t there every time. And of course, he also looks at products to see whether those products are actually serving the customer’s needs in a good way. And, and so I like his people process, product mentality.

Gary Stockton: Yeah. He seems to approach things with a great deal of empathy. When he’s having those hard conversations with the owners or partners, he has a way of just putting things out there in a plainly spoken way. He isn’t afraid to have the hard conversation and keep it real. And I love the show too. I think we could all learn a lot from him just by watching.

Richard Goeldner: It’s it’s amazing how he’s able to diffuse situations. He really does a great job.

Gary Stockton: So you’ve been involved in evaluating businesses and appraising businesses for some time. Is there a business that stands out to you maybe as the most interesting or most unusual that you had your hand in buying or selling?

Richard Goeldner: The most interesting, oh boy. I’ve had several I’m gonna go back to one that was very early in my career. A a business where the owner died and the son inherited the business, and he was an attorney, the son, and he actually wanted to go to seminary to become a priest, an episcopal priest, and he hadn’t shared that with his father before his father died, and this business has landed in his lap. And he didn’t really know much about the business or how to run it. And so for about a year, after his father died, we watched the business just gradually decline. And it was very sad to see. It was a company that, that specialized in cleaning manufacturing equipment in a particular sector.

And so, I found the niche to be very interesting in terms of the type of business it was, but it was really the story of what happened. To that business that that stands out the most to me. And what I didn’t know at the time is, they had obviously failed to plan the exit, and nowadays exit planning is very popular.

That term is bounced around, but exit planning is something that’s, been around probably ever since there’s been a business. But lack of planning can definitely damage the business and what you’re able to to get out of it. And so that’s really why I think of that one particular situation.

Gary Stockton: Wow, that’s interesting. My sister-in-law was going to take over the business, a shoe repair business for her father. And she did it for some time. She was taking real estate classes at the time, but she was known as the Huntington Beach Shoe Lady. Her business cards had the shoe, the lady that lives in the shoe.

But she, in the end it was not a fit for her really for environmental reasons, because California was changing the regulations on the glues that you can use to, to repair shoes and those types of things. It just became a very regulatory, risky place for her to be operating. And she got her real estate degree and is now got a thriving real estate career, so.

Richard Goeldner: It’s interesting.

Gary Stockton: Sometimes the business just may not be the right fit for a variety of reasons.

Richard Goeldner: Absolutely. And the example you gave, one of the major business risks was a regulatory risk.

Gary Stockton: Yeah. So any closing thoughts for small business owners contemplating buying or selling a business?

Richard Goeldner: Sure. I would say, for many owners, your business is your most valuable asset, but you won’t find the value of your business listed on your brokerage account statement. And so if the real value of your business matters to you I recommend investing in getting a business valuation, a formal business valuation so that you know where you stand and you can do that well in advance of selling your business.

You don’t need a business broker if you’re looking at selling in, three to five years, but you might want to know where you stand now, so that you can look at ways to improve the value of your business over the next few years as you prepare to sell.

Gary Stockton: Excellent advice Richard Goeldner, where can people learn more about you and buying or selling a business?

Richard Goeldner: I can be reached at it’s a long one. It’s rich@fairvalueadvisors.com. Or you can simply search for Fair Value Advisors online. You’ll find our website.

Gary Stockton: Awesome stuff Richard, thanks so much for coming on Small Business Matters and sharing your knowledge with us. Really appreciate it.

Richard Goeldner: Thank you so much I’ve enjoyed it.

Related articles:

The Top 4 Reasons for Placing an Accurate Value on Your Business