On July 16, the CFPB published its “first ever” monthly report providing a snapshot of complaints filed by consumers through the agency’s complaint portal. For full disclosure, Experian is one of the top three companies that received the most complaints from February through April 2015. But that is absolutely deceiving.

In reporting the complaint data, CFPB’s own press release said the company-level information provided in the report should be considered in the context of company size, but then failed to provide any context needed to understand the numbers.

Two of the more important points of context are that Experian is the largest consumer reporting agency in the United States and it touches more than 220 million consumers. Experian delivers approximately 1 billion credit reports annually. But this really is beyond the number of consumer files Experian maintains; it affects an entire industry.

In a letter to CFPB’s Richard Cordray, the Consumer Data Industry Association has asked that CFPB re-think how it publishes monthly report in the future, including adding context to the data it publishes. CDIA’s letter says that doing so would help the CFPB complaint portal live up to its stated goal to “…provide consumers with timely and understandable information to help enable them to make responsible financial decisions…”

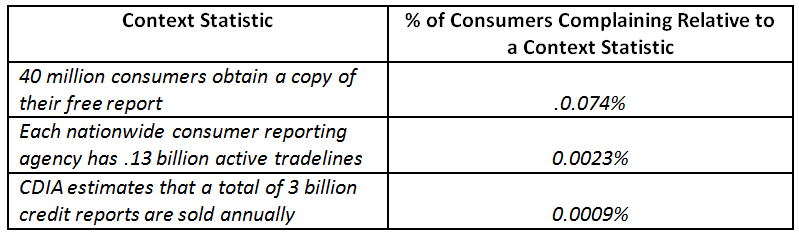

CDIA offers CFPB some worthy advice in its letter, citing back to the agency’s semi-annual report dated May 2014, where it disclosed that 29,600 complaints had been collected in the prior 18 months. CDIA’s letter contains a chart showing examples of how CFPB could put these complaints into context so that readers could more clearly understand them and so that consumers could be better informed. For more information, the letter is posted on CDIA’s Website.