How Long Does It Take to Get a Credit Score After Opening an Account?

Quick Answer

Credit scores are calculated using the information in your credit report, and you typically need three to six months of credit activity recorded there before a score can be created.

Dear Experian,I am an international student. It was very difficult for me to get a credit card application approved even after getting a job and getting a Social Security number. I applied for six cards, and I was finally approved for one, but I still do not have a credit score. How long will it take before I can actually see my credit score on the credit report? And how much of a negative impact will the six hard inquiries have on my credit score once it is generated?

- KLM

Dear KLM,

If you've just opened your first credit account, you probably won't have a credit score immediately. Accounts usually need to have a minimum of three to six months of activity before they can be used to calculate a credit score.

Credit scores are not part of credit reports but they do reflect the information in the report at the moment the score is calculated. Scores are used by lenders to evaluate the information within a credit report on an objective, numerical basis.

There are many different credit scoring companies, and the credit score that's used can vary by lender and the type of credit you're being evaluated for. Just how quickly a credit score can be calculated depends on the credit scoring formula being used and how quickly your lender reports the information about your new account to the credit reporting companies—Experian, TransUnion and Equifax.

For example, a VantageScore®™ credit score can often be calculated within a month of the account appearing on the credit report, but some versions of the FICO® ScoreΘ may require up to six months of account activity in order to generate a credit score. Other credit scoring formulas may have different time frames.

Accounts usually aren't reported until the end of the first billing cycle, when there is a payment status to report. For that reason, it's a good idea to allow a month or two before checking your report to see if the account is there.

If your new account does not yet appear on your credit report, you may want to check with your creditor to verify that they report to Experian and the other bureaus and to ask when you can expect it to appear on your report. While most major lenders and credit card issuers do report to the three national credit reporting agencies, it's always a good idea to verify before opening an account if your goal is to establish credit.

Using Your New Account to Build Credit

Once you open your first account, the most beneficial thing you can do for your credit scores is to manage it responsibly.

The two most important factors in credit scoring are your payment history and your credit utilization rate. Be sure to make all your payments on time and keep your credit card balances low, ideally paying your balance in full each month. The longer your account is active and in good standing, the better it is for your credit scores.

Credit Scores Are Not Part of a Credit Report

Credit scores are a tool to help determine the risk of lending to a person. They are calculated using the information from your credit report, but they are not part of your credit report. You will not see a credit score when you get your credit report, but a credit score may be included with your credit report in some cases.

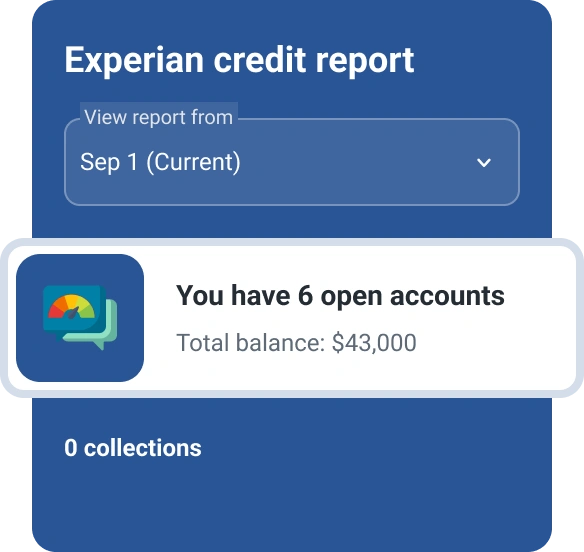

There are a number of ways to request your credit scores. You can view your free credit score from Experian online. When you get a credit score from Experian, you will also get a list of the risk factors that explain what information in your credit report most affected the score you received. These factors empower you to take action to improve your scores over time by addressing the issues they describe.

How Multiple Inquiries May Affect You

While multiple inquiries made within a short amount of time can sometimes be viewed as a sign of risk, any effect they have on your credit scores will be temporary and likely minimal.

Inquiries remain on your credit report for two years as a record of who has requested your credit information, but their impact begins to fade after only a few months.

Although you should be selective when applying for new credit going forward, the key to having strong credit is to be diligent in using your accounts responsibly. If you do that, you will be well on your way to achieving good credit scores.

What If I Don't Have a Credit Report Yet?

If you don't yet have an Experian credit report in your name, you can establish one right away with Experian Go™. Simply download the app and enroll in your free Experian membership to get started.

Experian will help you determine the best way to begin building your credit history. In some cases, you may be able to add accounts right away by using Experian Boost®ø to add your on-time payments on your utilities, cell phone, or streaming service accounts.

Thanks for asking.

Jennifer White, Consumer Education Specialist

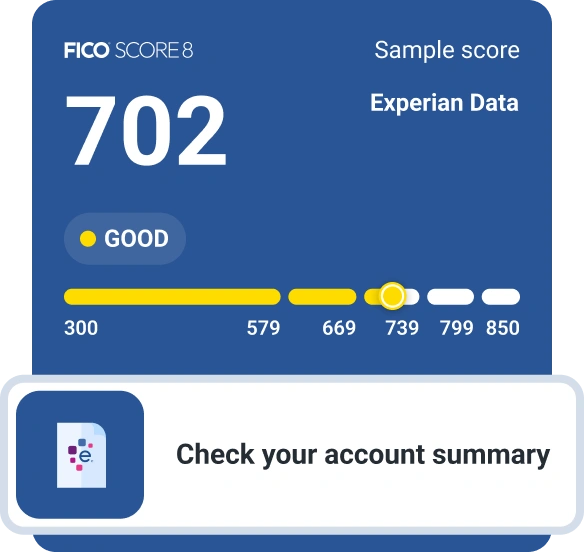

What makes a good credit score?

Learn what it takes to achieve a good credit score. Review your FICO® Score for free and see what’s helping and hurting your score.

Get your FICO® ScoreNo credit card required

About the author

Jennifer White brings nearly two decades of knowledge and experience to Experian’s Consumer Education and Awareness team. Jennifer’s depth of knowledge about the FCRA and how to help people address complex credit reporting issues makes her uniquely qualified to provide accurate, sound, actionable advice that will help people become more financially successful.

Read more from Jennifer