How Is Your Credit Score Calculated?

Quick Answer

Your credit score is based on five factors: payment history, how much you owe, length of credit history, new credit and credit mix. Payment history and amounts owed have the biggest impact.

Credit scoring models analyze your consumer credit reports and assign scores (often ranging from 300 to 850) using complex calculations. FICO® and VantageScore®, the two main consumer credit scoring models, evaluate information that indicates whether someone is likely to miss a payment.

A higher credit score means lower risk for creditors, which is why it can help you qualify for more favorable rates and terms from lenders. Specific factors and their weighting differ according to the credit scoring model and which credit bureau report (from Experian, TransUnion or Equifax) is used to calculate the scores. Read on to find out which factors determine your credit score.

Payment History

Your payment history, as it appears in your credit report, is typically the most important factor in determining your credit scores. Within this category, the scoring models consider:

- On-time payments: A history of paying your bills on time is good for your credit scores.

- Late payments: Payments made over 30 days late will typically be reported by your lender and hurt your credit scores. How far behind you are on a bill payment, the number of accounts that show late payments and whether you've brought the accounts current are all factors.

- Public records: Filing for bankruptcy can significantly hurt your credit scores.

The Fair Credit Reporting Act dictates how long negative information can stay on your credit report. Most negative marks, including late payments, last for up to seven years. Bringing past-due accounts current could help your scores, but negative marks may continue to have an impact for as long as they remain on your credit reports.

Learn more: How to Improve Your Payment History

Amounts Owed

Amounts owed, or your credit usage, comes just after payment history in importance when determining credit scores. The main consideration is your credit utilization rate—the comparison of current balances to credit limits on revolving accounts, mainly credit cards.

Follow these steps to calculate your utilization rate:

- Add up all of your credit card balances.

- Add up all of your credit limits.

- Divide the total of your balances by the total of your limits.

- Multiply by 100 to get a percentage.

Credit scoring models look at each revolving account's utilization rate as well as the overall rate across all accounts. In either case, it's best to keep your utilization under 30%. Those with the best credit scores tend to use under 10% of their available credit.

Ways to lower your utilization rate include paying down your balances or requesting credit line increases. Even if you pay in full monthly, you could have a high utilization rate. That's because scoring models use the balance your issuer reports to credit bureaus, which typically happens at the end of each statement period, weeks before your payment is due.

Making a payment during your statement period can lower your reported balance and resulting utilization rate.

Learn more: Should I Pay Off My Credit Card in Full or Over Time?

Length of Credit History

Responsibly managing credit accounts over a long period of time can help your credit scores. Credit scoring models may look at the age of your oldest account, newest account and the average age of all your accounts when factoring in credit history.

There's no shortcut to building a lengthy credit history, although becoming an authorized user on an account that the primary user has had for a long time may help. If you decide to close a credit card account in good standing, it can remain on your credit report for up to 10 years, and could continue to help your credit scores during that time.

However, closing an account reduces your overall available credit, which could have a negative effect on your scores.

Learn more: How Long Do Closed Accounts Stay on Your Credit Report?

New Credit

Recent credit activity isn't a major determinant in your credit score, but applying for and opening new accounts can affect it in a couple of ways.

Hard Inquiry

Submitting an application can lead to a hard inquiry, which is a record that someone reviewed your credit to make a lending decision. Hard inquiries can lower your scores by suggesting increased risk to lenders.

However, scoring models recognize that rate shopping for mortgage, auto or student loans doesn't make you extra risky. As a result, models combine multiple hard inquiries within a 14- to 45-day window (depending on the model), counting them as a single inquiry. Note that applying for credit cards doesn't receive the same treatment; each hard inquiry resulting from a credit card application is treated separately and not combined with other card applications. Hard inquiries remain on your credit reports for up to two years.

Soft inquiries, which occur when you check your own credit or when a lender preapproves you for an offer without a formal application, don't affect your credit scores.

New Account

Opening a new credit account lowers the average age of your accounts, which could slightly hurt your scores. At the same time, it also increases your available credit and presents an opportunity to make on-time payments on a new account in your credit report, which could help your scores over time.

Learn more: What Is Prequalification?

Types of Credit Accounts

Credit scoring models may also look for experience managing both revolving and installment credit accounts. Having a mix of accounts can help your scores.

Some credit scores are built for specific types of creditors, such as credit card issuers or auto lenders. Your experience with the correlated types of accounts could be more important for these types of scores.

Learn more: Does Opening a New Credit Card Improve Your Credit Score?

How Often Is Your Credit Score Updated?

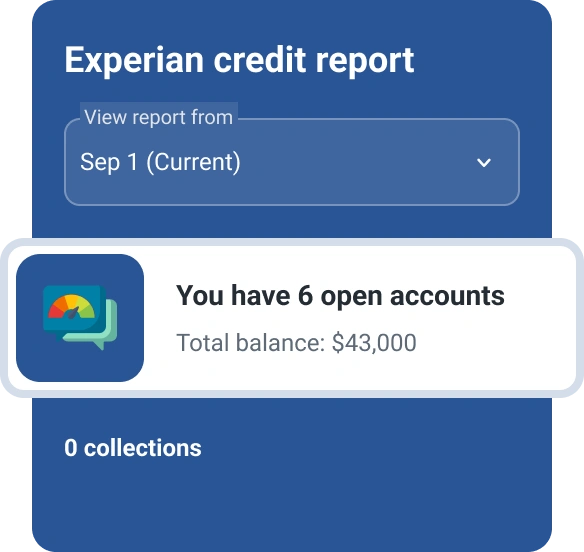

Your credit scores are always based on an analysis of one of your credit reports. Rather than being updated at specific intervals, a credit score is created when you (or someone else) requests it. New information could be added to your credit report at any time, which means the resulting score could change regularly.

You may also see different scores if you're checking credit reports from different credit bureaus, as it's not uncommon for there to be differences among your credit reports. Or, even if you're checking the same report at the exact same time, you could get different scores depending on which scoring model analyzes the report.

Learn more: Why Do I Have So Many Credit Scores With One Credit Bureau?

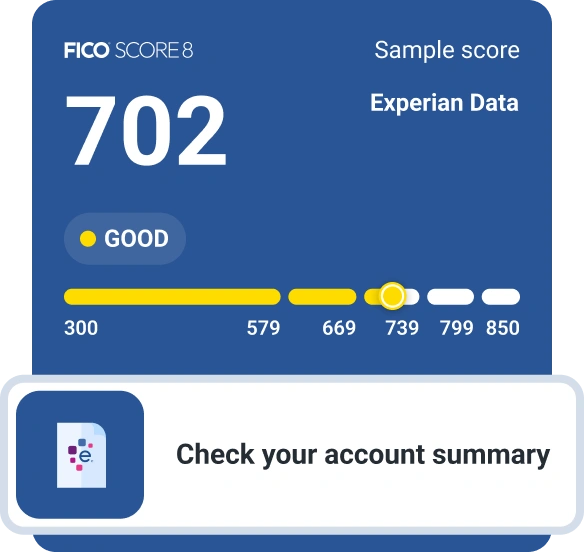

How to Check Your Credit Score for Free

You can check your FICO® ScoreΘ for free through Experian. When you register, you'll get access to your FICO® Score 8 based on your Experian credit report, along with insights into the factors affecting your score. You can monitor it as often as you'd like without hurting your credit.

Many other sources also offer free credit score access, including credit card issuers, banks and credit unions that provide scores as a member benefit, as well as credit monitoring services. These scores may use different scoring models or credit bureau data than what lenders see, but they're still useful for tracking your credit health over time.

How to Improve Your Credit Score

Improving your credit score takes time and consistent financial habits. Here are key strategies that can help:

- Pay all your bills on time. Payment history is the most important factor in your credit scores, so even a single late payment can significantly hurt your scores. Set up automatic payments or calendar reminders to ensure you never miss a due date.

- Keep credit card balances low. Aim to use less than 30% of your available credit, and ideally under 10% for the best scores. Pay down existing balances and consider making multiple payments throughout the month to keep your reported balance low.

- Limit new credit applications. Each application can result in a hard inquiry that temporarily lowers your scores. Only apply for new credit when you truly need it, and do your rate shopping for auto, home and student loans within a short window to minimize the impact.

- Keep old accounts open. The length of your credit history matters, so avoid closing your oldest credit cards, even if you're not using them regularly. Keeping these accounts open maintains your average account age and available credit.

- Diversify your credit mix. Having a variety of credit types, such as credit cards and an auto loan or a mortgage, can benefit your scores, though it's best to avoid taking on debt solely for this purpose.

- Address errors on your credit report. Review your credit reports regularly for inaccuracies; you have the right to dispute any errors you find. Correcting mistakes can sometimes lead to quick score improvements.

The Bottom Line

Understanding the factors that determine your credit scores empowers you to take control of your financial health. While building excellent credit takes time, focusing on consistent on-time payments, low credit utilization and responsible credit management will put you on the right path.

If you're ready to see where you stand, sign up for Experian's free credit monitoring tool, which allows you to monitor changes over time and get personalized insights into what's affecting your scores.

What makes a good credit score?

Learn what it takes to achieve a good credit score. Review your FICO® Score for free and see what’s helping and hurting your score.

Get your FICO® ScoreNo credit card required

About the author

Ben Luthi has worked in financial planning, banking and auto finance, and writes about all aspects of money. His work has appeared in Time, Success, USA Today, Credit Karma, NerdWallet, Wirecutter and more.

Read more from Ben