The Association of Certified Fraud Examiners has released their 2018 Report to the Nations: Global Study on Occupational Fraud and Abuse and small businesses should take heed. The annual report, which began in 1996, was implemented to identify cases of fraud in order to best address the problem.

The Report to the Nations identifies:

- how fraud is committed,

- how it is detected,

- who commits it and

- how organizations can protect themselves.

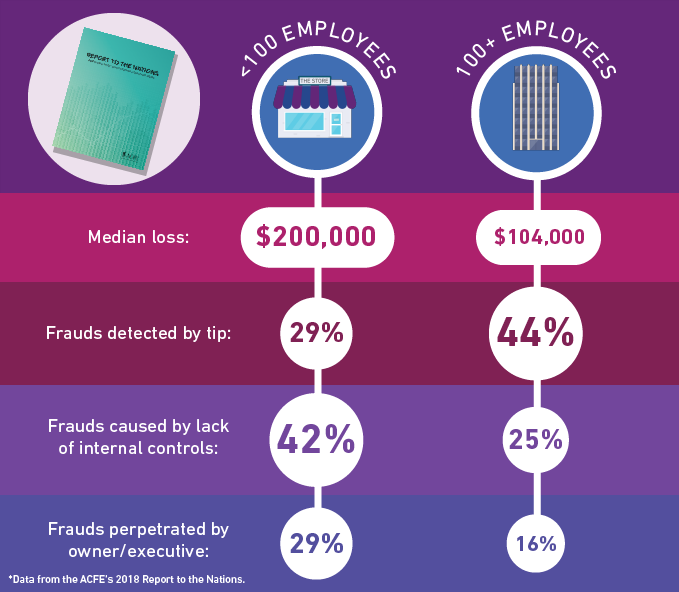

One of the key findings is that small businesses lose almost twice as much per fraud incident as larger businesses. Other key findings will be addressed in this article.

Experian spoke with Andi McNeal, co-author of the report and ACFE’s Director of Research, to dive deeper into the reports’ findings.

How is Occupational Fraud Harmful to Small Businesses?

Occupational fraud is when someone steals from their own company. For small businesses, fraud can be more impactful than in large businesses.

In the Report to the Nations, small businesses are identified as those with less than 100 employees as compared to larger businesses with 100 or more. According to the report, the median loss for small businesses is $200,000 versus $104,000 for large businesses. With the average amount of each incident nearly double, and with revenues likely much less than in larger businesses, this loss can be quite devastating to the business.

ACFE’s Director of Research, Andi McNeal, points out that the report doesn’t necessarily cover all industries, only 23 industry categories are included, so the average amount per industry can vary. However, considering the average size of small businesses, one single employee stealing $200,000 could wipe out the whole company.

How is Fraud Committed and Detected?

According to McNeal, the report was built on a survey of ACFE fraud examiners sharing case information from the prior 2 years. The current report looked at 2,690 cases of occupational fraud from all over the world, including 28% that were perpetrated in small businesses. The report revealed that fraud is typically found because there are few if any, internal controls to prevent and detect it.

In a small business, fraud can be perpetuated by:

- a co-owner

- one owner running personal purchases through the company or to family members

- the person controlling the bank account

With the average median duration of a fraud scheme lasting 16 months, corruption is the most common with 70% of cases perpetrated by a business leader. McNeal stated that the lack of internal controls contributed to almost half of all frauds. Most organizations, including those without reporting hotlines, are more than twice as likely to detect fraud only by accident. The unfortunate truth for small businesses is the “risk of fraud can be easily overlooked and quite devastating”.

In small businesses, owners are less likely to detect and report fraud. Owners and leaders operate on trust, even when formal policies are in place. Small business leaders are focused on operations and not necessarily concerned that someone is stealing from them. The Report to the Nations states that only 2% of owners will detect and report occupational fraud compared to 53% of employees. So having these conscientious whistleblowers among your ranks is your best line of defense.

How Can Small Businesses Protect Themselves from Fraud?

McNeal recommended internal controls to prevent and detect fraud. Small businesses have half the implementation rate of internal controls than larger businesses if they have any at all. Some of the internal controls that can help include:

- A Code of conduct

- Anti-fraud training

- Data analytics to control fraud

- 3rd party audits of financial statements

The best way to prevent fraud is to emphasize that fraud will be reported right away. McNeal recommended sitting down with staff to look over the company’s anti-fraud policy. This management procedure sends a strong message to staff to let them know that fraud will be taken seriously.

In other cases, employees did have suspicions of fraud but didn’t know what to do about it. Setting up a formal procedure of transparency, including a hotline program, allows employees to know there’s someone they can talk to. Empowered staff will speak up if given a directive of reporting concerning behaviors, including pressure or frustration. Some employees need an outlet instead of resorting to fraud.

Build a layer of management review. McNeal stated that if the small business owner opened the monthly bank statements, it could stop most small business fraud. Surprise accounting audits can also ensure the accounting procedures are truthful and accurate.

Final Thoughts on Detecting Small Business Fraud

Andi McNeal shared that there are many third-party businesses available to help detect fraud. ACFE Membership is made up of anti-fraud professionals, including many boutique firms. Some consultancies specialize in helping small business implement scaled anti-fraud programs. Business owners can decide which firms fit their need or make sense for the number of resources they have available. There are also resources online to help detect fraud and build internal controls.

Business owners need a clearer understanding of where their risk is, and which parts of their company are most vulnerable to fraud. Small business needs to pay special attention to their accounting department, including implementing processes and procedures. For instance, McNeal recommends that staff is cross-trained when someone is going on vacation or that more than one person is reviewing the accounting. Surprise audits are most effective. “Also,” said McNeal, “Management behaving in an ethical manner. If employees are watching management making ethical decisions in a grey area, then they may do the same. The tone is set from the top.”

Running background checks is also helpful, so small business owners do not hire those who have stolen before. According to McNeal, only 4% of fraudsters have been convicted of fraud prior to the cases in the report. 89% had no criminal background. Unfortunately, after the fraud is detected, fewer organizations are actually prosecuting the fraudsters. So businesses could be hiring first-time offenders or those who simply weren’t prosecuted because of cost if the previous victim was afraid of bad publicity or they believed the internal justice was sufficient. There should be appropriate consequences to help stop the propagation of fraud.

You can download this fascinating report from the Association of Certified Fraud Examiners website.