Starting a small business can be very hard. Building strong credit for the business takes discipline and a certain amount of intention. In this post, we are going to start by describing two imaginary business owners working hard down on Main Street.

Harry runs “Harry’s Hardware & Mercantile”, a busy hardware store. He has been trading with local do-it-yourselfers and contractors since 1973. Over the course of the business lifecycle, he established trade credit (Tradelines) with dozens of companies.

Mildred just opened “Millie’s Fabric” next door to Harry’s on a shoestring after she got laid off from her job. She founded Millie’s by borrowing money from friends and family, charging most of her startup costs to her personal credit card.

And that is where the paths of these two somewhat different businesses diverge. Harry discovered the benefits of establishing tradelines with his suppliers in the early stages of his business and now runs a resilient profitable business. Mildred is embarking on the difficult challenge of establishing her business and will need to manage her cash flow wisely. Like Harry, she will discover how beneficial tradelines will be to her success as she starts to form relationships with trading partners.

What are tradelines and how can they benefit my business credit report?

Tradelines or trade information comprises the financial payment obligations that a business has to its creditors, suppliers, and service providers that involve payment terms like Net 15, Net 30, 60 or 90. It means your business has that much time to pay back the balance of what you borrow. So, for example, if your business buys $300 worth of products at Net 30 terms, you have 30 days to pay it back.

A business will start to add tradelines over the course of its lifecycle and establishing tradelines early in the life of the business can be very beneficial. Experian gets a lot of questions about how tradelines impact a business credit score, so in this post, we explain how that all works.

Things to consider before applying for tradelines

- Establish a legal entity. In order for any business to establish trade terms with your company, take the steps to establish the business as a legal entity (ie; forming an LLC, or S Corporation), sole proprietors should make sure the business is registered with your Secretary of State.

- Establish separate bank accounts. Separate bank accounts will help keep finances separate and help your business track accounts payables.

- Business email and contact information. Your vendor will look for signs of credibility when assessing whether or not your business is legitimate. Having a business email address in the name of the company helps in that effort. Avoid using free email services like Yahoo or Gmail.

- Establishing a presence for your business on social media such as Facebook, Twitter, Instagram, LinkedIn or YouTube, depending where your customers spend time online.

Bootstrapping a business in start-up is becoming more common, but the mistake that many business owners will make is leveraging their personal credit for company expenses. Doing this can hurt the owner’s personal credit, and it will not help to build strong credit for the business. It is much more beneficial to establish the business and start applying for credit in the name of the company.

Trade supplier types

When your business orders raw materials for your business, or purchases office supplies, you would sign for the goods and receive an invoice, and be provided a period of weeks to pay the balance. If your vendor is reporting to Experian, your payment history good or bad will be reported and be a contributing factor in your business credit score.

Experian classifies these tradelines as trade supplier types and groups them into the following categories.

| Financial | loan, line, lease, credit card |

| Supply | raw materials, building supply, office |

| Services | accounting, marketing, financial services |

| Utilities | telecommunications, gas, water, electricity |

| Transportation | ground, air transport |

If you are familiar with consumer credit reports, you should be familiar with financial trades, as they are on our consumer credit reports too. These tradelines include loans, lines of credit, leases, and credit cards. Commercial credit reports also include trades from other supplier types as well. Basically, any business that has a commercial accounts receivable portfolio can provide their information to Experian and can establish a tradeline for their business accounts. To contribute data to Experian, you must be able to export into TXT, CSV or XLS (Excel – saved as comma delimited) and also adhere to encryption guidelines. Data contributors are also required to submit monthly updates. If you are interested in becoming a business data contributor you can find more information about reporting to Experian here.

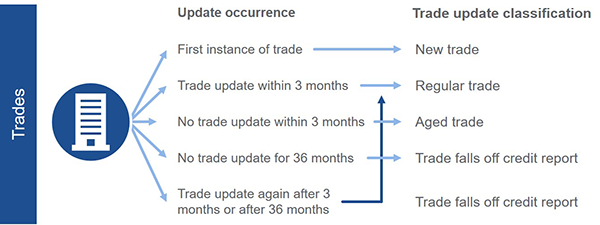

How tradelines are classified and updated

The first time Experian gets a trade from a specific data supplier for business, that is considered a new trade. On the next update of that trade, it is reclassified as a regular trade. If there are no updates to a regular trade within 3 months, it becomes an aged trade. A trade falls off the business credit report without an update in 36 months. It doesn’t end there; however, if an update comes in for an existing trade, even for a trade that fell off the business credit report, it becomes a regular trade again.

Tradeline credit attributes

Experian provides information on the total balance outstanding, total credit and utilization, payment delinquencies as of today, and payment trends over time. With this type of grouping, it’s easy to quickly identify newly added trades, regularly updated trades, and trades that are becoming stale.

The tradeline disparity between male-owned and woman-owned small businesses

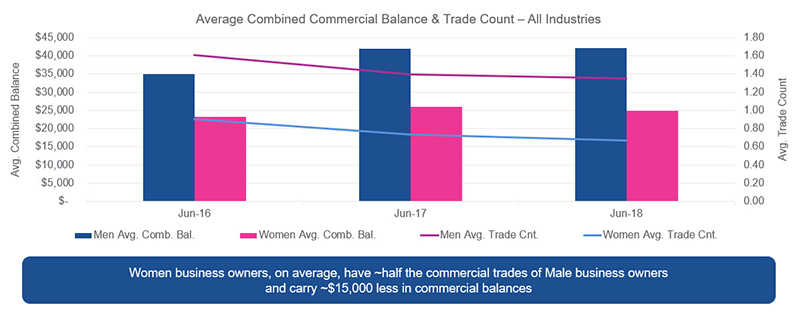

Experian studied 3.1 million small business credit profiles between 2016 and 2018 and found variances in the number of tradelines in male-owned businesses compared to woman-owned businesses as the chart below describes.

When we look at trade count and the amount of commercial debt or outstanding balances, we saw a different picture between the two cohorts. On average woman business owners have less than 1 tradeline ( avg. .6 trades) vs male business owners, who average roughly 1.4 commercial tradelines. When you compare the average balances, male business owners carry about $40,000 in commercial credit while women business owners carry about $25,000, a $15,000 difference.

This difference in the number of tradelines puts women-owned businesses at a competitive disadvantage. To be competitive small businesses should strongly consider establishing tradelines and making on-time payments to these lines.

How can tradelines help small businesses gain access to capital?

Tradelines can help your business develop the credibility that matters to banks and other capital lenders. A business credit report that includes multiple, positive lines of trade credit in your company’s name shows that your business pays its creditors in a timely manner.

Commercial Lenders review this business credit history of tradelines to determine whether to fund a loan or capital, as well as the interest rates and repayment terms if capital is extended. Businesses with good trade credit often qualify for loans with lower interest rates and better payment terms than those with poor or limited trade credit history.

For more information about establishing business tradelines check out our post Building Strong Tradelines For Your Small Business.