Tax season is officially underway. As Americans take to their computers and preparer’s offices to file their taxes and, in many cases, wait for a refund, tax identity thieves are lying in wait to steal it. Tax identity theft is a rising threat to American taxpayers. In 2020 alone, the IRS flagged more than 5 million tax refunds for fraud, a nearly 50% increase over the previous year, according to the Taxpayer Advocate Service 2020 Annual Report to Congress.

What is tax identity theft?

Tax identity theft happens when someone uses personal stolen information, like a Social Security number, to file a fraudulent tax refund. Often, the crime occurs before the legitimate taxpayer even has a chance to file their return. Tax identity theft robs consumers of their financial power, can delay their tax refund for months, and take years to resolve.

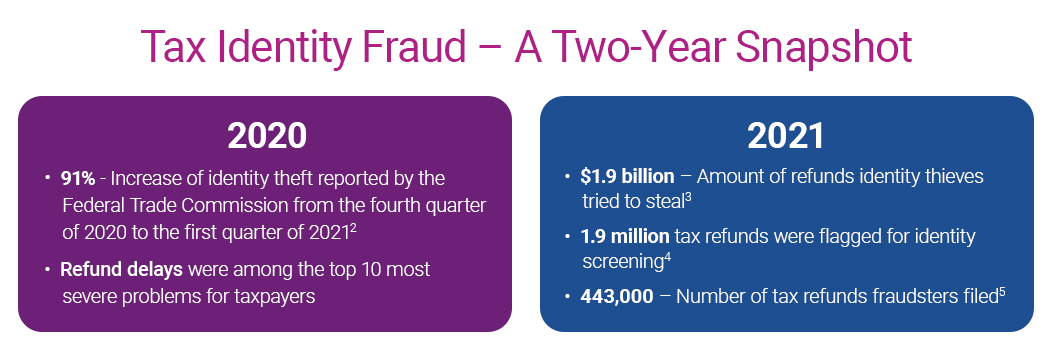

A two-year snapshot

“Tax Season Six” – Here are six ways your consumers can help prevent tax identity theft:

- File early: Don’t give fraudsters a chance to cash in on your refund. Gather W-2’s, 1099’s if you’re a freelancer or small business owner, 1098 forms for your mortgage and student loan interest, and other documents required on your financial situation. Submit your state and federal taxes well before the tax filing, which falls on Monday, April 18 this year.

- Keep an eye on your mailbox: In addition to digital copies, employers and financial institutions send physical tax documents via the United States Postal Service (marked ‘tax document enclosed). Identity thieves pay close attention to unattended mailboxes during tax time, so be sure to visit and empty your mailbox daily and keep it under lock and key – this also goes for P.O. boxes.

- Keep Social Security numbers safe: Accessing a vulnerable Social Security Number can result in fraudulent tax crime. Practice safe SSN habits all year and especially during tax season by shredding documents with the nine-digit number, storing physical cards in a secure location, like a lockbox, and leaving the card at home unless necessary.

- Know how to spot phishing and smishing scams: The Internal Revenue Service website, IRS.gov, received more than 1.8 billion visits in 2021. While most Americans were likely looking for answers around filing, many others logged on to learn more about the authenticity of a phone call, notice, or email they received “from the IRS