Experian data shows consumers are more confident managing their credit since the recession.

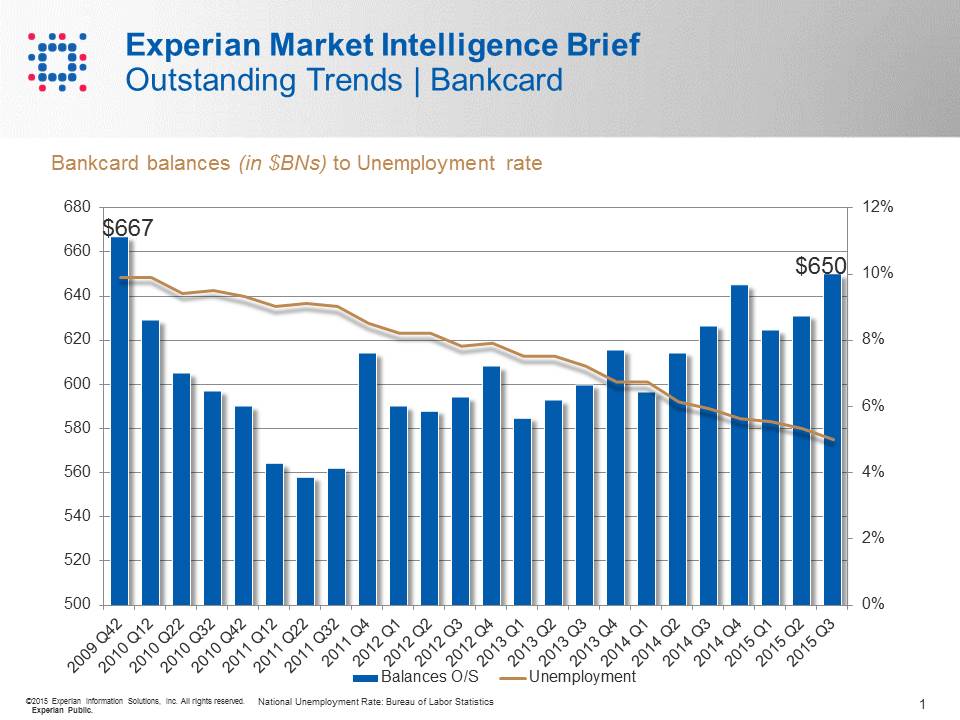

The Q3 2015 Experian Market Intelligence Brief was released today featuring data that highlights consumer credit card debt has now reached its highest level since Q4 2009. Credit card debt levels reached $650 billion in Q3 2015, the highest it has been since Q4 2009 when it was $667 billion.

Credit card delinquency rates on outstanding balances 60 or more days past due have decreased 71 percent during the same time period. Combining those indicators with the national unemployment rate dropping 50 percent during the same span illustrates a positive economic outlook on credit card trends among lenders and consumers.

“Overall credit card limits have increased 102 percent since Q4 2009 with $82 billion originated in Q3 2015,” said Kelly Kent, vice president of Experian Decision Analytics. “The increase in limits from lenders and the steady climb in credit card debt combined with exceptional delinquency rates signals greater confidence among consumers as they are showing more assurance in managing their credit since the recession. We expect to see credit card debt increase in Q4 based on historical seasonal trends driven by the holiday shopping season especially with the early positive holiday sales as a sign.”

The Q3 2015 Experian Market Intelligence Brief report is now available.